Loading

Get Irs Instruction 706 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS Instruction 706 online

Filling out the IRS Instruction 706 can seem daunting, but with a clear guide, you can navigate the process with confidence. This guide provides step-by-step instructions on completing this essential document online, empowering you to handle estate tax responsibilities efficiently.

Follow the steps to complete the IRS Instruction 706 online.

- Click ‘Get Form’ button to obtain the form and open it in your editing tool.

- Begin with Part 1—Decedent and Executor. Enter the decedent's social security number and provide the name and address of the executor. If there are multiple executors, include details for each.

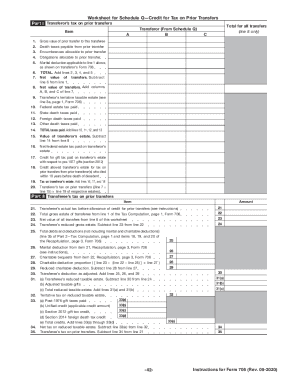

- Continue to Part 2—Tax Computation. Here, you will need to report the gross estate value, applicable deductions, and calculate the estate tax using the provided rate schedule.

- Move to Part 3—Elections by the Executor where you may elect alternate valuation or special-use valuation for farm property.

- Complete Part 4—General Information with required information regarding the estate's administration and any exemptions.

- Proceed to Part 5—Recapitulation. Ensure all entries are complete, including totals for each schedule.

- Fill in Parts 6, 7, and additional schedules as necessary, depending on specific estate circumstances and assets.

- Review your entries for accuracy and ensure you include any required attachments such as a death certificate and the decedent's will.

- Once satisfied, save your changes. You may then download, print, or share the completed form as required before submission.

Start completing your IRS Form 706 online today and ensure your estate tax responsibilities are met.

Estate tax closing letters will only be issued upon request by the taxpayer or taxpayer's representative. There are two options for making a request for an estate tax closing letter: By facsimile to 855-386-5127 or 855-386-5128, or. By calling 866-699-4083.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.