Loading

Get Va Dot 502 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT 502 online

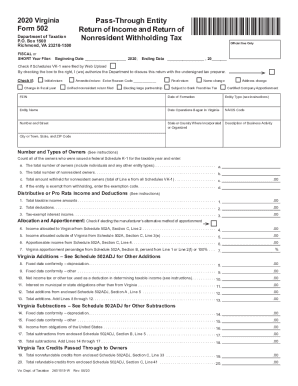

This guide provides comprehensive steps to assist users in filling out the VA DoT 502 form online. By following these instructions, you will navigate through each section with ease, ensuring your submission is accurate and complete.

Follow the steps to successfully complete the VA DoT 502 online.

- Click the ‘Get Form’ button to obtain the form and open it in the editing interface.

- Begin by entering the fiscal or short year filer information, including the beginning and ending dates of the fiscal year. Ensure these dates accurately reflect the reporting period.

- Input the Federal Employer Identification Number (FEIN), the date of formation, and the entity type in the designated fields.

- Provide the entity name, date operations began in Virginia, and the North American Industry Classification System (NAICS) code.

- Complete the section on the number and types of owners by listing the total number of owners and their respective resident statuses.

- Record the financial details including total taxable income, deductions, and any tax-exempt interest income as necessary.

- In the income allocation section, allocate income to Virginia and outside Virginia as appropriate.

- Calculate and input any additions or subtractions from enclosed schedules, ensuring to reference the provided instructions.

- Complete the withholding payment reconciliation section accurately reflecting taxes due and any overpayments.

- Review all entered information thoroughly before finalizing the form.

- Once satisfied with your entries, you can save changes, download, print, or share the completed form as required.

Complete your VA DoT 502 form online today to ensure timely and accurate filing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you can use the standard deduction on your Federal return but itemize on your Oregon state return. There is nothing in the Federal tax laws that say you must use the same deductions on your Federal and state returns. It is governed by each state instead.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.