Loading

Get Mo Form E-1r 2020-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the MO Form E-1R online

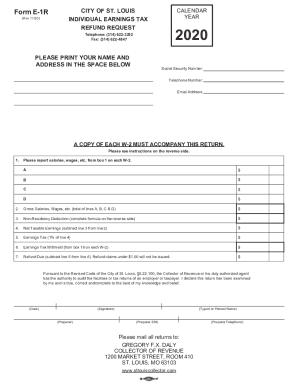

Filling out the MO Form E-1R is an essential step for non-residents seeking a refund of the earnings tax. This guide will walk you through each section of the form, ensuring you have the information needed to complete it accurately and efficiently.

Follow the steps to successfully complete the MO Form E-1R online.

- Press the 'Get Form' button to access and open the MO Form E-1R for completion.

- Begin by entering your name and address in the designated spaces at the top of the form.

- Input your Social Security number, telephone number, and email address in the specified fields.

- Attach copies of each W-2 form to your submission, ensuring to follow the guidelines provided.

- On lines A, B, C, and D, report your salaries and wages as indicated on box 1 of each W-2.

- Calculate the total gross salaries and enter this sum on box 2.

- Utilize the non-residency deduction formula located on the reverse side of the form and report your findings on line 3.

- Subtract the non-residency deduction (line 3) from the total gross (line 2) to determine your net taxable earnings, and enter this value on line 4.

- Calculate your earnings tax by taking 1% of the net taxable earnings (line 4) and record the result on line 5.

- Enter the total amount of earnings tax withheld as reported in box 19 on your W-2 forms on line 6.

- To determine the refund due, subtract the earnings tax (line 5) from the earnings tax withheld (line 6) and write this amount on line 7.

- Finally, review all entries for accuracy, save the changes, and proceed to download, print, or share the form as needed.

Complete your MO Form E-1R online today to ensure your refund request is processed promptly.

Form E-234 is a business tax return to report and pay the earnings tax of 1% due. ... Not-For-Profit or Non-Profit businesses are exempt from filing and paying taxes after a photocopy of the Certificate issued by the Federal or State government has been filed with the Office of the Collector of Revenue.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.