Loading

Get Va Form Rdc 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA Form RDC online

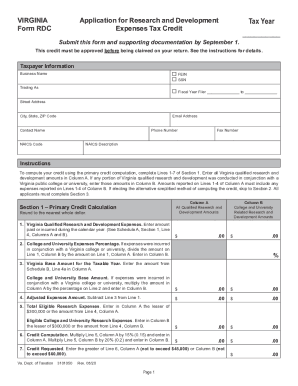

This guide provides a comprehensive and user-friendly approach to completing the VA Form RDC online. The form is essential for claiming the research and development expenses tax credit in Virginia, and the following steps will guide you through each section.

Follow the steps to successfully complete the VA Form RDC online:

- Press the ‘Get Form’ button to acquire the form and open it in your preferred online editor.

- Begin by entering your taxpayer information in the designated fields, including your business name, Federal Employer Identification Number (FEIN), Social Security Number (SSN), and trading as name. Make sure to include your fiscal year details, street address, city, state, ZIP code, email address, and contact name.

- Input your NAICS code, along with your phone and fax number, followed by the NAICS description.

- Proceed to Section 1 to compute your credit. Fill out Lines 1-7 with the Virginia qualified research and development amounts as directed. Ensure you round to the nearest whole dollar.

- For Line 1, enter the amount paid or incurred during the calendar year for Virginia qualified research and development expenses in Column A. If applicable, detail any amounts related to a Virginia college or university in Column B.

- Continue with calculations in Section 1, entering necessary data for Lines 2-7, including the College and University Expenses Percentage and the Virginia Base Amount.

- If using the alternative simplified method, skip to Section 2 and complete the required calculations as per your circumstances.

- In Section 3, provide additional information related to your credit claim, including employee details and the nature of your research activities.

- Once all sections are filled out accurately, review your entries for completeness and correctness.

- Finally, you can save changes, download, print, or share the completed form as needed.

Start filing your VA Form RDC online today to ensure you benefit from the available tax credits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Do not attach correspondence or other items unless required to do so. Attach Forms W-2 and 2439 to the front of Form 1040. If you received a Form W-2c (a corrected Form W-2), attach your original Forms W-2 and any Forms W-2c. Attach Forms W-2G and 1099-R to the front of Form 1040 if tax was withheld.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.