Loading

Get Sc Schedule Nr 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the SC Schedule NR online

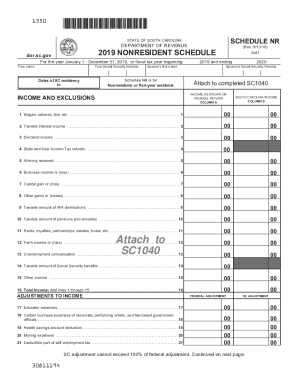

Filling out the SC Schedule NR is an essential step for nonresidents or part-year residents of South Carolina to report their income accurately. This guide will provide you with detailed, step-by-step instructions to help you complete the form online with confidence.

Follow the steps to complete the SC Schedule NR online

- Press the ‘Get Form’ button to access the SC Schedule NR and open it in your online editor.

- Begin by entering your name and Social Security number at the top of the form.

- Specify the dates of your South Carolina residency, indicating the start and end dates.

- For individuals filing jointly, enter your spouse's first name and Social Security number in the given fields.

- In Column A, list your income as it appears on your federal return, filling in the appropriate amounts for wages, taxable interest, dividends, and any other income sources.

- In Column B, input the corresponding amounts for South Carolina income next to each income type listed.

- Calculate your total income by adding all lines from 1 through 15 in Column B.

- Proceed to the adjustments section, where you will detail any adjustments to your income, such as educator expenses or self-employment tax.

- Ensure to include South Carolina-specific adjustments by filling out the relevant lines for additions and subtractions.

- Calculate your total South Carolina adjustments and your modified adjusted gross income as instructed.

- If applicable, proceed to determine the deductions adjustment, whether you are taking the standard deduction or itemizing.

- Finally, after all calculations are complete, review the South Carolina taxable income and make sure it is accurate before saving the document.

- You may now save changes, download, print, or share the completed form as needed.

Complete your SC Schedule NR online today to stay on track with your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Veteran Property Taxes Veterans with a 100 percent service-connected disability are eligible for a total exemption of property tax on their homes as well as a homestead tax deduction of up to $50,000.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.