Loading

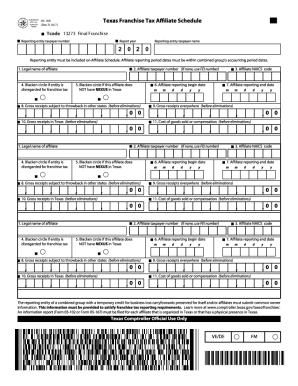

Get Tx Comptroller 05-166 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TX Comptroller 05-166 online

Filing the TX Comptroller 05-166 form online is a straightforward process that helps users complete their tax obligations efficiently. This guide provides a step-by-step approach to successfully filling out the form, ensuring that all required information is accurately provided.

Follow the steps to accurately complete the TX Comptroller 05-166 form online.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- Review the first section of the form, which typically includes instructions and a summary of the information required. Familiarize yourself with these details before proceeding.

- Complete the identification section where you will be required to enter the legal name of your business, doing business as (DBA) name, and your federal employer identification number (FEIN). Ensure accuracy as this information is crucial.

- Proceed to the financial information section. Here, you will input your gross receipts, total sales, and other financial data as required. Double-check your figures to avoid discrepancies.

- In the compliance section, confirm your eligibility for any exemptions or deductions. You may be prompted to provide supporting documentation, so be prepared to upload files if necessary.

- Review the final section, which typically includes a declaration and signature area. Confirm that all information is complete and validate your identity digitally, if required.

- Once you have filled out all necessary fields, save your changes, download the completed form, and print a copy for your records. Ensure to share it with any relevant stakeholders as needed.

Start completing the TX Comptroller 05-166 online today!

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

All taxable entities must file a franchise tax report, regardless of annual revenue. The initial franchise tax report is due one year and 89 days after the organization is recognized as a business in Texas.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.