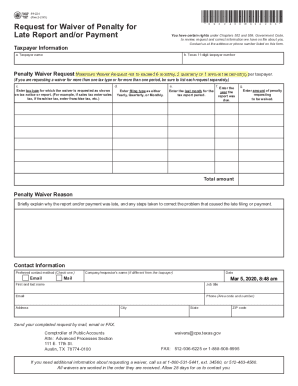

Get TX 89-224 2020-2024

How It Works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign Texas 89 224 online

How to fill out and sign Texas comptroller penalty waiver online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

Tax form completion can turn into a significant obstacle and serious headache if no appropriate guidance offered. US Legal Forms has been developed as an online resolution for TX 89-224 e-filing and offers many benefits for the taxpayers.

Utilize the tips about how to complete the TX 89-224:

-

Discover the template online within the specific section or via the Search engine.

-

Press the orange button to open it and wait until it?s done.

-

Review the template and pay attention to the recommendations. If you have never completed the sample before, follow the line-to-line recommendations.

-

Focus on the yellowish fields. They are fillable and need particular data to become inserted. In case you are uncertain what data to put in, see the guidelines.

-

Always sign the TX 89-224. Utilize the built in instrument to produce the e-signature.

-

Click the date field to automatically insert the appropriate date.

-

Re-read the template to press and change it before the submission.

- Hit the Done button in the upper menu when you have accomplished it.

-

Save, download or export the accomplished template.

Utilize US Legal Forms to guarantee secure and simple TX 89-224 completion

How to edit 89 224 texas: customize forms online

Your easily editable and customizable 89 224 texas template is within reach. Make the most of our library with a built-in online editor.

Do you postpone completing 89 224 texas because you simply don't know where to begin and how to move forward? We understand how you feel and have an excellent solution for you that has nothing nothing to do with fighting your procrastination!

Our online catalog of ready-to-edit templates allows you to search through and select from thousands of fillable forms adapted for a number of purposes and scenarios. But obtaining the file is just scratching the surface. We provide you with all the needed features to complete, sign, and change the template of your choosing without leaving our website.

All you need to do is to open the template in the editor. Check the verbiage of 89 224 texas and verify whether it's what you’re searching for. Begin completing the template by using the annotation features to give your document a more organized and neater look.

- Add checkmarks, circles, arrows and lines.

- Highlight, blackout, and correct the existing text.

- If the template is meant for other users too, you can add fillable fields and share them for others to complete.

- As soon as you’re done completing the template, you can download the file in any available format or choose any sharing or delivery options.

Summing up, along with 89 224 texas, you'll get:

- A powerful suite of editing} and annotation features.

- A built-in legally-binding eSignature solution.

- The ability to generate forms from scratch or based on the pre-drafted template.

- Compatibility with various platforms and devices for greater convenience.

- Numerous options for protecting your documents.

- A wide range of delivery options for easier sharing and sending out documents.

- Compliance with eSignature laws regulating the use of eSignature in online transactions.

With our professional option, your completed forms are usually lawfully binding and fully encoded. We make certain to protect your most vulnerable details.

Get all it takes to make a professional-searching 89 224 texas. Make the correct choice and attempt our platform now!

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Video instructions and help with filling out and completing comptroller texas gov forms

Watch this brief video to get answers on many questions you will have while completing the 89 224 form. Save time and effort for more important things with these short guidelines.

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Keywords relevant to tx 89 224

- 2016 89 224

- request for waiver of penalty

- 89 224 type

- texas 89 224 form

- texas waiver form

- form 89 224 type

- texas comptroller forms online

- preferred contact method form

- penalty waiver texas comptroller

- 2016 89224 waiver

- 2016 89224 late

- requestors

- COMPTROLLER

- ext

- Attn

USLegal fulfills industry-leading security and compliance standards.

-

VeriSign secured

#1 Internet-trusted security seal. Ensures that a website is free of malware attacks.

-

Accredited Business

Guarantees that a business meets BBB accreditation standards in the US and Canada.

-

TopTen Reviews

Highest customer reviews on one of the most highly-trusted product review platforms.