Loading

Get Irs 1120 - Schedule D 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 1120 - Schedule D online

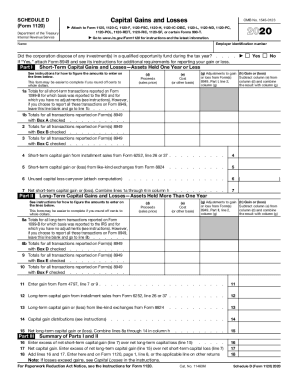

Filling out the IRS 1120 - Schedule D is an important step in reporting capital gains and losses for your corporation. This guide provides clear, step-by-step instructions to help you complete this form accurately and efficiently online.

Follow the steps to complete the form with ease.

- Click the ‘Get Form’ button to obtain the form and open it in your preferred editor.

- Begin by entering your employer identification number and name at the top of the form.

- Indicate whether the corporation disposed of any investments in a qualified opportunity fund during the tax year by selecting 'Yes' or 'No'. If 'Yes', attach Form 8949 and refer to its instructions for additional requirements.

- In Part I, report short-term capital gains and losses for assets held one year or less. For each transaction, enter the proceeds from sales in column (d), the cost or other basis in column (e), and calculate the gain or loss in column (h) by subtracting the cost from the proceeds.

- Use line 1a for totals of all short-term transactions reported on Form 1099-B. If you are reporting all transactions on Form 8949, leave it blank and proceed to line 1b.

- Repeat for checks in Boxes A, B, and C to report short-term transactions as required. Enter any applicable amounts for installment sales and like-kind exchanges on lines 4 and 5 respectively.

- Sum all short-term gains and losses from lines 1a to 6 to arrive at net short-term capital gain or loss on line 7.

- In Part II, repeat the process for long-term capital gains and losses for assets held more than one year. Again, enter proceeds and cost in the respective columns and calculate the gain or loss.

- Use line 8a for totals of long-term transactions reported on Form 1099-B. Proceed with checks for Boxes D, E, and F for additional reporting.

- Complete your calculations, including any necessary adjustments or gains from specific forms, and arrive at the net long-term capital gain or loss on line 15.

- Finalize your overall net capital gain on lines 16 and 17, entering the total on line 18, which should then be transferred to Form 1120 or other applicable returns.

- After completing the form, save your changes, and choose to download, print, or share the document based on your needs.

Complete your IRS 1120 - Schedule D online today for a streamlined filing experience.

The current capital gains tax rates under the new 2018 tax law are zero, 15 percent and 20 percent, depending on your income. The 2018 capital gains tax rate is holding steady through 2019, but the income required for each rate has changed.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.