Loading

Get Dc Otr D-76 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the DC OTR D-76 online

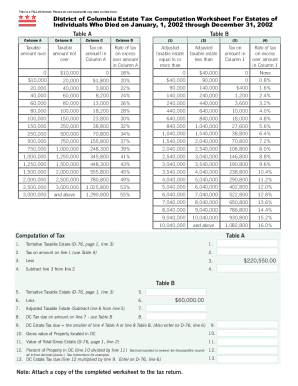

This guide provides step-by-step instructions on how to complete the DC OTR D-76 estate tax return online. The D-76 form is an essential document for reporting the estate taxes of individuals who have passed away, ensuring compliance with local tax regulations.

Follow the steps to successfully complete your DC OTR D-76 form online.

- Press the ‘Get Form’ button to access the D-76 estate tax form and open it in your editing platform.

- Enter the gross value of property located in the District of Columbia in Line 1. Ensure this is the fair market value as appraised.

- At Line 2, input the total gross estate amount as calculated from the Recapitulation (Form D-76, page 2).

- In Line 3, enter the total allowable deductions that apply to your estate. This is critical for determining the taxable amount.

- Calculate the tentative taxable estate by subtracting the total allowable deductions (Line 3) from the total gross estate (Line 2) at Line 4.

- Use the DC Estate Tax Computation Worksheet to determine the DC estate tax due, and enter this amount in Line 5.

- If there's a payment made with Form D-77 or any extensions, enter that information in Line 6.

- If your payment exceeds what is due, reflect this overpayment on Line 7. Alternatively, if you owe more than what you’ve paid, indicate the balance due in Line 8.

- Review your entries thoroughly. Make sure your account information is correct for direct deposits if applicable. Ensure all attached documents are uploaded.

- Once all information is complete and accurate, save your changes. Download, print, or share the form as necessary.

Complete your documentation today by filling out the DC OTR D-76 form online.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The federal estate tax is collected on the transfer of a person's assets to heirs and beneficiaries after death. ... An estate valued at $10,000 more than the 2019 federal estate tax exemption is taxed at a rate of 18%, while an estate that exceeds the exemption amount by $1 million or more is taxed at 40%.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.