Loading

Get Ut Ustc Tc-569d 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-569D online

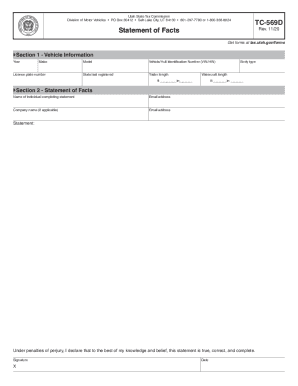

The UT USTC TC-569D is an essential form for providing a statement of facts regarding vehicle and watercraft registration in Utah. This guide will help you navigate the online process for filling out this form accurately and efficiently.

Follow the steps to complete your statement of facts online.

- Click the ‘Get Form’ button to access the TC-569D document. This will open the form in your online editor, allowing you to begin filling it out.

- In Section 1, fill out the vehicle information. You will need to provide details such as the year, make, model, license plate number, and Vehicle/Hull Identification Number (VIN/HIN). Additionally, indicate the state where the vehicle was last registered, along with the trailer length and body type if applicable. For watercraft, enter the length in feet and inches.

- Proceed to Section 2, where you will provide the name of the individual completing the statement. Include their email address and the company name, if relevant. Ensure this information is accurate as it may be used for communication regarding your submission.

- Complete the statement section by confirming the accuracy of your information. You will need to sign the form to affirm that the information provided is true, correct, and complete to the best of your knowledge. Remember to date your signature.

- Once you have filled in all the required fields, you can save the changes made to the form. Choose to download, print, or share the document as needed to complete your submission process.

Take the next step in managing your documents by filling out your forms online now.

The median annual property tax paid by homeowners in Utah County is $1,411. That is the sixth highest rate in Utah but is still nearly $700 less than the national average. Total rates in Utah, which apply to assessed value, range from 0.946% to 1.539%. In Provo, the total rate is 1.079%.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.