Loading

Get Ut Ustc Tc-569a 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the UT USTC TC-569A online

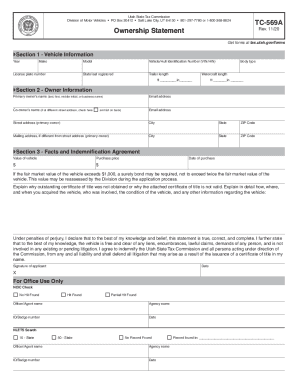

The UT USTC TC-569A form is an essential document for reporting vehicle ownership and ensuring proper title documentation in Utah. This guide provides step-by-step instructions on how to complete the form efficiently and accurately online.

Follow the steps to complete your UT USTC TC-569A form online.

- Click 'Get Form' button to obtain the form and open it in the editor.

- In section 1, fill out the information regarding the vehicle. Enter the year, make, model, license plate number, and Vehicle/Hull Identification Number (VIN/HIN). Specify the state where the vehicle was last registered, trailer length, body type, and watercraft length if applicable.

- Move to section 2, where you will enter the owner information. Provide the primary owner’s full name (last, first, middle initial, or business name) and, if applicable, the co-owner’s name. Include the primary owner's and co-owner's email addresses and the primary owner’s street address, city, state, and ZIP code. If the mailing address differs, include that information as well.

- Proceed to section 3, where you will state the vehicle's value and purchase price. Fill in the date of purchase. Note that if the fair market value exceeds $1,000, a surety bond may be required, not to exceed twice the fair market value.

- In the explanation section, provide detailed information on why the certificate of title was not obtained or why the attached title is invalid. Include where, how, and when the vehicle was acquired, the condition of the vehicle, and any involved parties.

- Lastly, review the indemnification agreement and sign the document. Enter the date of signing. This section acknowledges the truthfulness of the statement and indemnifies the Utah State Tax Commission from any liability regarding the title issuance.

- Once all sections are filled out, save your changes, and download or print the form for your records, or share it as needed.

Complete your UT USTC TC-569A form online today for efficient processing and accurate documentation.

Utah standard deduction Here are the federal standard deductions for 2018: $12,000 for single filers or those married filing separately. $24,000 for married filing jointly or qualifying widow(er) $18,000 for head of household.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.