Loading

Get Fl Dor Dr-1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the FL DoR DR-1 online

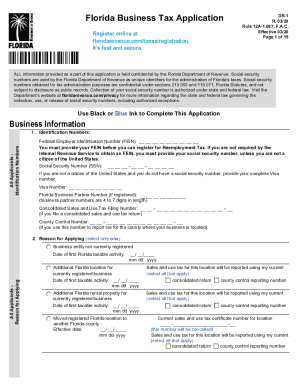

The Florida Department of Revenue's DR-1 form is essential for businesses looking to register for various tax purposes. This guide provides easy-to-follow steps to help you accurately complete the form online, ensuring a smooth registration process.

Follow the steps to fill out the FL DoR DR-1 form online.

- Click ‘Get Form’ button to obtain the form and access it in the editor.

- Begin with the 'Business Information' section. Provide your Identification Numbers, including your Federal Employer Identification Number (FEIN) or Social Security Number (SSN) if applicable. Ensure the information is accurate to avoid delays in processing.

- Select the 'Reason for Applying' by checking only one box that best describes your situation. Ensure to provide the date of first taxable activity as required.

- Fill in the 'Business Name, Location, and Mailing Address' section with the required details, including the legal name of the business and the physical address. If applicable, check the box if your address is outside the U.S.

- In the 'Form of Business Ownership' section, select only one option that describes your business entity, such as sole proprietor or partnership.

- Complete the necessary information for business owners and managers, partners, or corporate officers as applicable, ensuring to provide accurate contact and identification details.

- Provide information regarding your business activities, including the six-digit North American Industry Classification System (NAICS) code that describes your business.

- If applicable, answer questions regarding employees, reemployment tax, and communications services tax accurately.

- Review the 'Authorization for Email Communication' section if you wish to receive information regarding your application via secure email.

- Finally, ensure you sign and date the application appropriately before submitting. Save your changes, and you can download, print, or share the completed form as needed.

Complete your Florida Business Tax Application online today for swift and secure processing.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Companies who pay employees in Florida must register with the Florida Department of Revenue for a Reemployment Tax Account Number. Register online with the FL DOR to receive an online confirmation number. Then, after 3 business days, call the FL DOR at 850-717-6629 to obtain the account number and rate information.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.