Get Tn Rv-f1300901 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the TN RV-F1300901 online

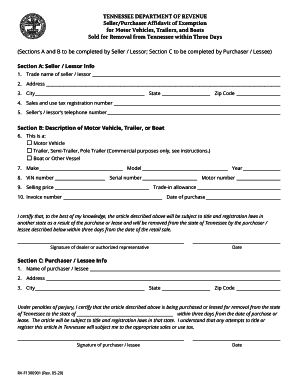

Filling out the TN RV-F1300901 form is essential for facilitating tax exemptions on the sale or lease of motor vehicles, trailers, and boats that are removed from Tennessee within three days. This guide provides a comprehensive walkthrough of each section of the form to ensure that users can complete it accurately and efficiently.

Follow the steps to successfully complete the TN RV-F1300901 form online.

- Click the 'Get Form' button to access the TN RV-F1300901 form online, allowing you to fill it out in a digital format.

- In Section A, complete the seller or lessor information by entering the trade name, address, city, state, zip code, sales and use tax registration number, and telephone number.

- In Section B, specify the type of item being sold (motor vehicle, trailer, or boat) and provide relevant details, including make, model, year, VIN number, serial number, motor number, selling price, trade-in allowance, invoice number, and date of purchase.

- Ensure your signature and the date are included at the end of Section B to certify that the information provided is accurate to the best of your knowledge regarding the item's removal from Tennessee.

- In Section C, the purchaser or lessee must fill in their name, address, city, state, and zip code. They also need to certify the purchase and state to which state the item will be taken.

- The purchaser or lessee must sign and date their section, acknowledging penalties for perjury if the information is misrepresented.

- After completing the form, users can save changes, download, print, or share the TN RV-F1300901 form as needed.

Complete your TN RV-F1300901 form online today to ensure a smooth transaction and take advantage of tax exemptions.

First, you'll need to apply for an employer identification number (EIN). This is a requirement for all tax-exempt organizations, even if they don't have employees. You can apply online through the IRS website, by phone at 1-800-829-4933, or by mailing in Form SS-4, Application for Employer Identification Number.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.