Loading

Get Irs 8824 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8824 online

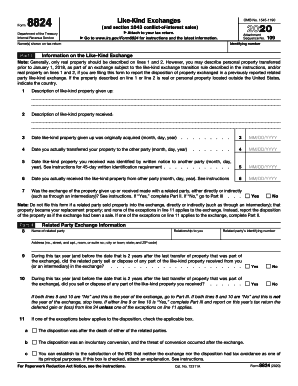

The IRS Form 8824 is specifically designed to report like-kind exchanges, which allows taxpayers to defer recognition of capital gains on the exchange of certain properties. This guide will provide you with clear, easy-to-follow instructions on completing the form online.

Follow the steps to fill out the IRS Form 8824 online effectively.

- Press the ‘Get Form’ button to access the IRS Form 8824 and open it in your preferred editor.

- Enter your identifying number and the names as shown on your tax return in Part I of the form.

- Provide detailed descriptions of the like-kind property you gave up and the property you received on lines 1 and 2, ensuring to include the location if outside the United States.

- Record the dates you originally acquired the property given up and the date you transferred it to the other party on lines 3 and 4, respectively.

- Identify the date you notified another party in writing about the like-kind property received on line 5.

- Complete line 6 by providing the date you actually received the like-kind property.

- Indicate whether the exchange involved related parties on line 7. Answer 'Yes' or 'No' accordingly to determine your next steps.

- If applicable, provide information about the related party exchange in Part II, including names, relationships, and identifying numbers.

- Proceed to Part III to record realized gains or losses, ensuring to fill out lines 12 to 25 as prompted based on the property given up and received.

- Complete Part IV only if relevant to report gains related to section 1043 conflict-of-interest sales, following the instructions provided for each line.

- Once you have completed all necessary sections, save your changes, and download, print, or share the form as required.

Complete your IRS Form 8824 online to ensure accurate reporting of your like-kind exchanges.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Like-kind exchange treatment now applies only to exchanges of real property that is held for use in a trade or business or for investment. ... Improved real property is generally of like-kind to unimproved real property. For example, an apartment building would generally be of like-kind to unimproved land.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.