Loading

Get Irs 990 - Schedule R 2020

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 990 - Schedule R online

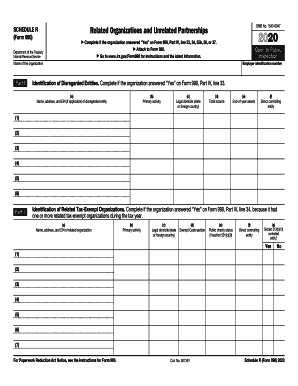

This guide provides a comprehensive overview of how to complete the IRS 990 - Schedule R form online. Schedule R is necessary for organizations that have related organizations or partnerships and is crucial for proper tax reporting.

Follow the steps to complete Schedule R efficiently.

- Click ‘Get Form’ button to access the IRS 990 - Schedule R and open it in your preferred editor.

- Begin with Part I, which requires identification of disregarded entities. For each disregarded entity, fill in the name, address, and EIN (if applicable), mark the primary activity, legal domicile, total income, end-of-year assets, and direct controlling entity.

- Proceed to Part II, where you identify related tax-exempt organizations. Fill in the name, address, and EIN of each related organization, describe their primary activity, indicate their legal domicile, state the exempt code section and public charity status, and note if they are a controlled entity.

- Continue to Part III to identify related organizations taxed as a partnership. Input the necessary details such as name, address, EIN, primary activity, legal domicile, and details regarding income and asset shares.

- Then move on to Part IV, which addresses related organizations treated as a corporation or trust. Similarly, provide the required information regarding each related organization.

- In Part V, report any transactions with related organizations. Indicate if you engaged in various transactions such as receiving or giving gifts, loans, or dividends, and provide details in the corresponding fields.

- Complete Part VI if your organization has unrelated organizations taxable as a partnership. Fill in the required information regarding each entity that conducts a significant portion of your organization's activities.

- Finally, proceed to Part VII to provide any supplemental information necessary for your previous responses. Ensure that all required areas are complete.

- Review the entire document for accuracy. Once satisfied, you can save your changes, download the filled-out form, print it for records, or share it as needed.

Start filling out your IRS 990 - Schedule R online to ensure accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Publicly available data on electronically filed Forms 990 is available in a machine-readable format through Amazon Web Services (AWS). The data includes Form 990, Form 990-EZ and Form 990-PF and related schedules, with the exception of certain donor information, from 2012 to the present.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.