Loading

Get In Dor Bas-1 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN DoR BAS-1 online

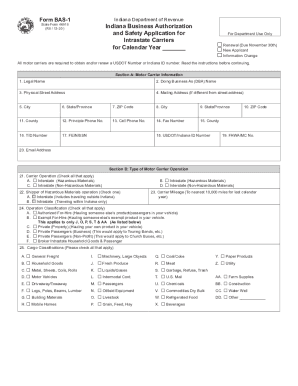

The IN DoR BAS-1 form is essential for motor carriers in Indiana to obtain or renew their business authorization. This guide provides clear, step-by-step instructions on how to accurately complete the form online, ensuring your submission meets all necessary requirements.

Follow the steps to successfully complete the IN DoR BAS-1 online.

- Click the ‘Get Form’ button to access the form and open it in the editor.

- Begin with Section A by entering the motor carrier information. This includes the legal name, 'Doing Business As' (DBA) name if applicable, physical street address, and mailing address if different.

- Continue in Section A by providing the city, state, ZIP code, county, and main contact information including principal phone number, cell phone number, fax number, TID number, FEIN/SSN, USDOT/Indiana ID number, FHWA/MC number, and email address.

- Move to Section B to indicate the type of motor carrier operation. Check all applicable boxes for the types of operations that apply to your business.

- For Section B, enter carrier mileage for the last calendar year and classify operations under the appropriate categories.

- In Section C, select the business type (individual, partnership, corporation, LLC) and provide proof of public liability security by entering your insurance information, including the policy number and insurance company.

- Complete the certification statement section by having an authorized official sign, date, and print their name and title.

- Before final submission, ensure all information is accurate; then save changes, download, print, or share the completed form as necessary.

Complete your IN DoR BAS-1 form online today to ensure your motor carrier operation is compliant and authorized.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Withholding allowance refers to an exemption that reduces how much income tax an employer deducts from an employee's paycheck. ... The more allowances you claim, the less income tax will be withheld from a paycheck; the fewer allowances you claim, the more tax will be withheld.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.