Loading

Get Ny Dtf Ct-300 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the NY DTF CT-300 online

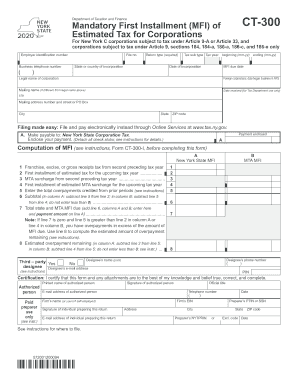

Filling out the NY DTF CT-300 form is essential for New York C corporations to submit their mandatory first installment of estimated tax. This guide will walk you through each section of the form, ensuring you understand the process and can complete it accurately.

Follow the steps to successfully complete the NY DTF CT-300 form online.

- Click ‘Get Form’ button to obtain the CT-300 form and open it in your document management application.

- Enter your employer identification number in the designated field.

- Fill in your business telephone number. Ensure it is accurate for effective communication.

- Specify your file number, if applicable, in the appropriate section.

- Choose the return type required for this filing.

- Indicate your state or country of incorporation.

- Select the tax sub-type for your corporation and specify the tax year, including the beginning and ending dates in the format mm-yy.

- Enter the date of incorporation of your corporation.

- Input the due date for the MFI.

- Provide the legal name of your corporation in the specified area.

- If a foreign corporation, indicate the date you began business in New York State.

- If the mailing name differs from the legal name, include that information.

- Fill in the mailing address, including number and street or PO Box, city, state, and ZIP code.

- Provide payment details as instructed, making the check payable to New York State Corporation Tax.

- Begin the computation of MFI by filling out lines 1 through 8: enter relevant taxes, estimated taxes for the upcoming year, and any overpayments from prior periods.

- Review and verify that the totals are correct, especially line 7 which indicates the total MFI due.

- Provide the designee's name, if applicable, and indicate whether they are a third-party designee.

- Complete the certification section by providing the printed name, signature, email address, and telephone number of the authorized person.

- If utilizing a paid preparer, fill in the preparer's details, including firm’s name, printed name, and signature.

- Once all sections are completed, save your changes, download, print, or share the form as needed.

Begin filling out your NY DTF CT-300 form online today!

Related links form

The Tax Cuts and Jobs Act of 2017 changed the top corporate tax rate from 35% to one flat rate of 21%. This rate will be effective for corporations whose tax year begins after January 1, 2018, and it is a permanent change. The corporate tax rate also applies to LLC's who have elected to be taxed as corporations.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.