Loading

Get Va Dot R-1 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the VA DoT R-1 online

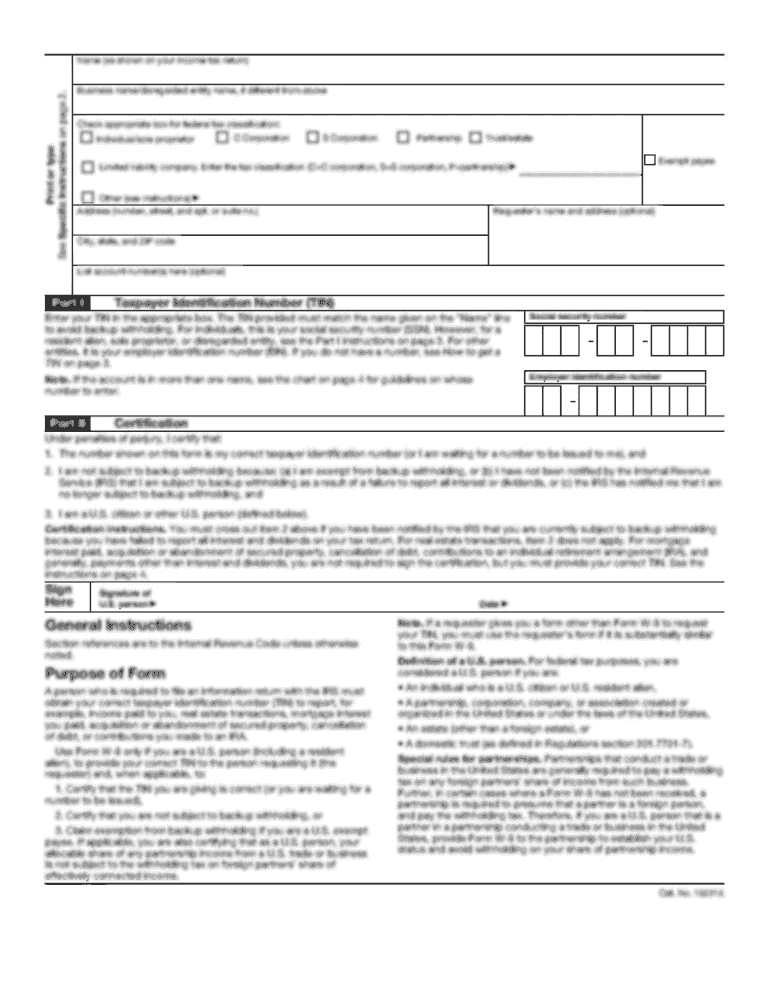

The Virginia Department of Taxation Business Registration Form, also known as the VA DoT R-1, is essential for anyone looking to register a new business or update existing business information. This guide provides clear, step-by-step instructions to help users successfully complete the form online.

Follow the steps to complete the VA DoT R-1 online.

- Press the ‘Get Form’ button to access the VA DoT R-1 and open it in a suitable editor.

- Begin by providing your business profile information in Section I. Enter the full legal name of your business in the appropriate field, and if you are a sole proprietor, include your name (first, middle initial, last).

- Fill in your Federal Employer Identification Number (FEIN), as this number is mandatory for registration. If you do not have one, you may obtain it from the IRS.

- If you are a sole proprietor, include your Social Security Number (SSN) in the designated space.

- Select your entity type by checking the appropriate box, making sure to review the options carefully to choose the correct classification.

- Provide your Trading As Name (or Doing Business As Name) if applicable; this is the name recognized by the public.

- Describe your primary business activity clearly in the designated space. If applicable, check the boxes for selling tobacco products or operating a food establishment.

- Fill in your primary business address, ensuring to include the full street address, city, state, and ZIP code.

- If your mailing address differs from your primary business address, complete the relevant sections with the mailing details.

- Provide primary contact information for an authorized individual who can discuss tax matters for your business.

- Move to Section II and list responsible parties. Include names, SSNs, relationships, and addresses for required corporate or partnership officers.

- Continue through the sections, filling out tax liability information as it pertains to your business for sections including Annual Tax, Employer Withholding Tax, Retail Sales and Use Tax, and Communications Tax.

- In Section IX, ensure the form is signed by an authorized individual, affirming the information provided is accurate.

- Once you have filled out all applicable sections, save your changes. You can then download, print, or share the completed form as needed.

Start filling out your VA DoT R-1 online today for seamless business registration!

Virginia has a progressive state income tax system with four tax brackets that range from 2% to 5.75%. The bracket you fall into will depend on your income. Since the highest rate applies to income over $17,000, most Virginia taxpayers will find themselves paying the top rate.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.