Loading

Get In St-108e 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IN ST-108E online

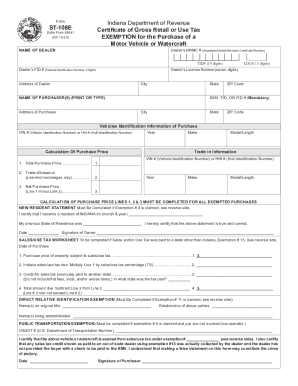

The IN ST-108E form, issued by the Indiana Department of Revenue, is essential for claiming exemption from sales and use tax on motor vehicles or watercraft purchases. This guide provides clear, step-by-step instructions for completing the form online to ensure a smooth filing process.

Follow the steps to complete the IN ST-108E form accurately.

- Click the ‘Get Form’ button to access the IN ST-108E form and open it in an online editor.

- Enter the dealer's information, including the dealer's Registered Retail Merchant Certificate Number (RRMC #), TID#, FID#, and license number. Additionally, fill in the dealer's address, including city, state, and ZIP code.

- Provide the purchaser's details by entering their name, Social Security Number (SSN), TID, or FID#. Complete their address information, including city, state, and ZIP code.

- Fill in the vehicle identification information, such as the VIN# or HIN#, and the year of the vehicle or watercraft purchase.

- Calculate the total purchase price by filling out the designated line for the total amount. If applicable, include trade-allowance information.

- Complete the trade-in information if relevant, including the trade-in vehicle identification and details.

- Ensure the net purchase price is accurately calculated by subtracting the trade-allowance from the total purchase price.

- If claiming exemption #8, complete the New Resident Statement detailing the previous state of residence and the date of residency in Indiana.

- If relevant, fill out the Sales/Use Tax Worksheet for taxes previously paid to another state by completing the required calculations and providing information about the state where the tax was paid.

- Complete any applicable exemption statements related to direct relatives, public transportation, or any other exemptions claimed.

- Review all information for accuracy and completeness before finalizing entries.

- Once all fields are filled, you may save changes, download, print, or share the completed form as needed.

Complete your IN ST-108E form online today to ensure you meet your tax exemption needs efficiently.

Usage Tax-A six percent (6%) motor vehicle usage tax is levied upon the retail price of vehicles transferred in Kentucky. Retail Tax could be 6% of the current average retail listed in the NADA Used Car Guide, 6% of the sale price or 90% of the MSRP (Manufacturer's Suggested Retail Price) for new vehicles.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.