Loading

Get Ca Transient Occupancy Tax Return 2020-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA Transient Occupancy Tax Return online

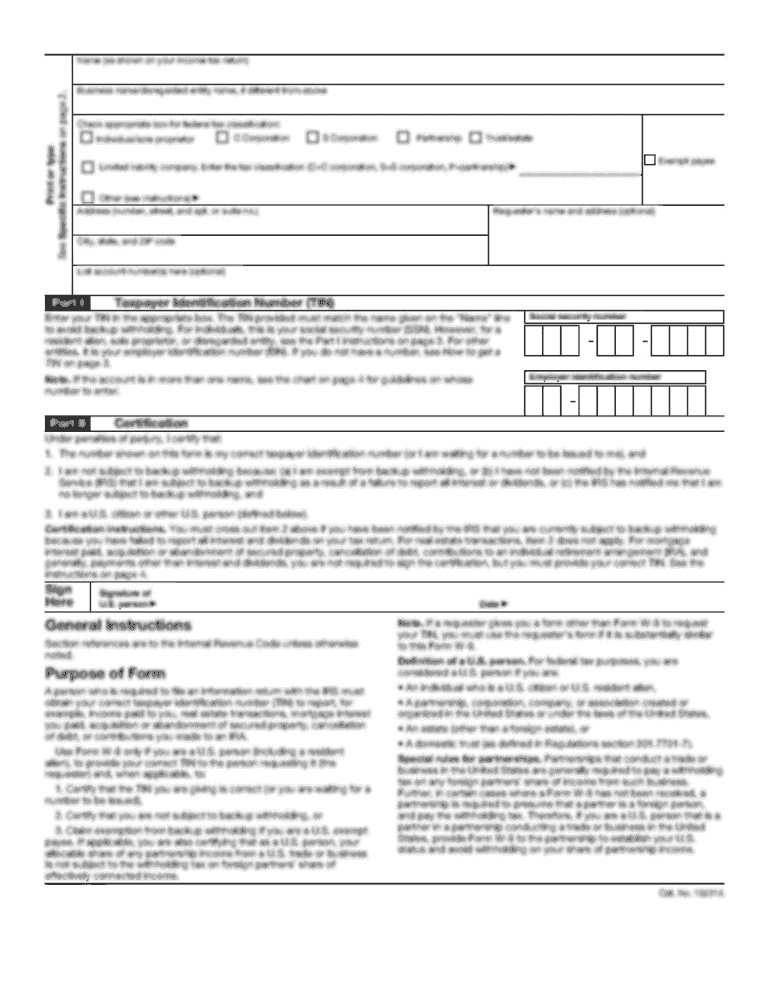

Completing the CA Transient Occupancy Tax Return online is a straightforward process that allows you to report your rental activities efficiently. This guide will walk you through each section of the form to ensure accurate and timely submission.

Follow the steps to complete the CA Transient Occupancy Tax Return online.

- Press the ‘Get Form’ button to access the CA Transient Occupancy Tax Return form and open it in your preferred editor.

- Fill in the current month and year for which you are reporting on the form. Ensure accuracy to avoid issues.

- Enter the establishment name and street address in the designated fields, ensuring that the street address includes the street number and name.

- Provide the city and zip code where your establishment is located.

- Input your city account number, which is also known as your business license number, as it is necessary for accurate processing.

- Calculate and enter the average occupancy for the reporting month, calculated by dividing the number of occupied rooms by the total number of available rooms.

- In the computation section, list the total rents received for the current month’s stays in the appropriate field.

- Detail any allowable deductions in the specified section. This includes rents from stays longer than 30 days and any federal employee or diplomatic stays on official business.

- After applying deductions, calculate the taxable rental receipts and input this amount in the designated field.

- Calculate the transient occupancy tax due by taking 12% of the taxable rental receipts and entering that amount.

- If applicable, add any penalties related to late payments and input the total amounts due for both transient occupancy tax and penalties.

- Repeat the allowance and calculation processes for the TBID assessments, noting occupied units and appropriate exemptions.

- Compute the total TBID assessment and penalties due, ensuring accuracy in your calculations.

- Finally, determine the total amount due by adding both the TOT taxes and TBID assessments, then save your changes.

- After completing all fields, you can download, print, or share the form as necessary.

Get started on your CA Transient Occupancy Tax Return online today.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.