Loading

Get Ks 85a 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the KS 85A online

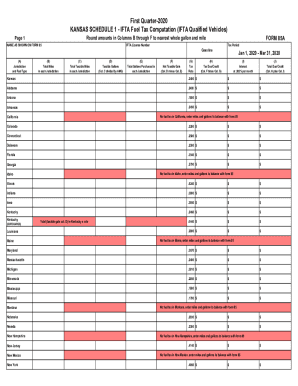

Filling out the KS 85A form can seem daunting, but this guide will help you navigate each section with ease. Follow these steps to ensure that your fuel tax computation is completed accurately and efficiently.

Follow the steps to fill out the KS 85A form accurately and confidently.

- Click ‘Get Form’ button to obtain the KS 85A form and open it for editing.

- Enter your IFTA license number in the designated field. This number is essential for processing your fuel tax computation.

- Provide the name as it appears on your Form 85 in the appropriate section. This ensures that your information matches the registered records.

- In Column B, input the total miles traveled in each jurisdiction. Make sure to enter whole numbers, rounding to the nearest mile.

- In Column C, fill in the total taxable miles for each jurisdiction. Again, round amounts to the nearest whole mile.

- Calculate the taxable gallons in Column D by dividing the amounts from Column C by the average miles per gallon (AMG). Input these values rounded to the nearest gallon.

- In Column E, report the total gallons purchased in each jurisdiction. Round these amounts as instructed.

- Column F requires you to calculate the net taxable gallons by subtracting Column E from Column D. Ensure these figures are accurate.

- In Column G, enter the applicable tax rates for each jurisdiction. Ensure these rates are current and accurate.

- For Column H, calculate the tax due or credit by multiplying the values in Column F by Column G.

- In Column I, calculate the interest at a rate of 0.583% per month based on the amounts due.

- Finally, in Column J, sum the amounts of Column H and Column I to determine the total due or credit.

- After completing all fields, review your entries for accuracy. You can now save changes, download, print, or share the KS 85A form as needed.

Start filling out your KS 85A form online today for a seamless tax filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

All types of retirement income are subject to Connecticut's income tax, although Social Security is exempted for some seniors. The state has a sales tax near the national average and some of the highest property taxes in the U.S.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.