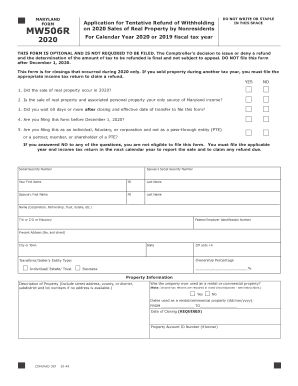

Get Md Mw506r 2020

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign MD MW506R online

How to fill out and sign MD MW506R online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

Nowadays, most Americans tend to prefer to do their own income taxes and, in addition, to fill out papers in electronic format. The US Legal Forms web-based platform helps make the procedure of submitting the MD MW506R simple and hassle-free. Now it will require no more than half an hour, and you can accomplish it from any place.

Tips on how to fill up MD MW506R fast and easy:

-

View the PDF template in the editor.

-

Refer to the outlined fillable fields. Here you can place your data.

-

Click the variant to choose if you see the checkboxes.

-

Check out the Text tool and other powerful features to manually edit the MD MW506R.

-

Confirm all the details before you continue to sign.

-

Make your exclusive eSignature using a key pad, camera, touchpad, computer mouse or cell phone.

-

Certify your template online and place the date.

-

Click Done proceed.

-

Save or deliver the record to the recipient.

Ensure that you have filled in and delivered the MD MW506R correctly in due time. Consider any applicable term. When you provide incorrect details with your fiscal papers, it can lead to severe penalties and cause problems with your yearly tax return. Be sure to use only qualified templates with US Legal Forms!

How to edit MD MW506R: customize forms online

Check out a standalone service to deal with all of your paperwork easily. Find, edit, and complete your MD MW506R in a single interface with the help of smart tools.

The days when people needed to print forms or even write them by hand are over. Today, all it takes to get and complete any form, like MD MW506R, is opening a single browser tab. Here, you will find the MD MW506R form and customize it any way you need, from inserting the text directly in the document to drawing it on a digital sticky note and attaching it to the document. Discover tools that will streamline your paperwork without additional effort.

Simply click the Get form button to prepare your MD MW506R paperwork quickly and start editing it instantly. In the editing mode, you can easily fill in the template with your details for submission. Simply click on the field you need to change and enter the data right away. The editor's interface does not demand any specific skills to use it. When done with the edits, check the information's accuracy once again and sign the document. Click on the signature field and follow the instructions to eSign the form in a moment.

Use More tools to customize your form:

- Use Cross, Check, or Circle tools to pinpoint the document's data.

- Add textual content or fillable text fields with text customization tools.

- Erase, Highlight, or Blackout text blocks in the document using corresponding tools.

- Add a date, initials, or even an image to the document if necessary.

- Utilize the Sticky note tool to annotate the form.

- Use the Arrow and Line, or Draw tool to add visual components to your document.

Preparing MD MW506R forms will never be complicated again if you know where to find the suitable template and prepare it easily. Do not hesitate to try it yourself.

Get form

Maryland's 23 counties and Baltimore City levy a local income tax which we collect on the state income tax return as a convenience for local governments. ... Local officials set the rates, which range between 1.75% and 3.20% for the current tax year. You should report your local income tax amount on line 28 of Form 502.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.