Loading

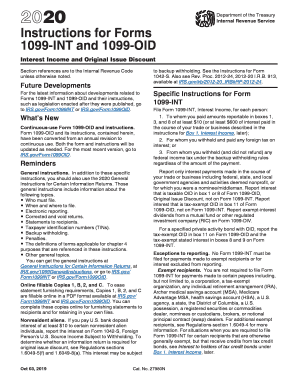

Get Irs Instruction 1099-int & 1099-oid 2020-2025

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to use or fill out the IRS Instruction 1099-INT & 1099-OID online

This guide provides step-by-step instructions for filling out the IRS Instruction 1099-INT & 1099-OID forms online. Whether you are familiar with tax documents or not, this comprehensive walkthrough will ensure you complete these forms accurately and efficiently.

Follow the steps to successfully complete your IRS forms online.

- Click ‘Get Form’ button to obtain the form and open it in an editor.

- Fill out your name and address in the designated fields as required. Make sure to provide accurate contact information.

- Enter the recipient’s details including their name, address, and Taxpayer Identification Number (TIN) in the corresponding fields.

- Report the relevant interest income amounts in the appropriate boxes (Box 1 for taxable interest, Box 3 for U.S. Savings Bonds interest, etc.). Ensure you only include amounts that meet the reporting criteria.

- If applicable, indicate any foreign tax paid by entering this information in the relevant box.

- Complete any additional sections required, such as reporting backup withholding amounts if the recipient did not provide their TIN.

- Review all entries for accuracy, ensuring no fields are left incomplete that are required.

- Save your changes and choose an option to download, print, or share the completed forms as needed.

Complete and file your IRS documents online today for a smoother tax season.

Form 1099-INT Accrued Interest. ... The accrued interest is taxable to the seller, whereas the interest that is earned from the date of purchase to the end of the year is taxable to the purchaser.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.