Loading

Get Ca Ftb 593-v 2021

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the CA FTB 593-V online

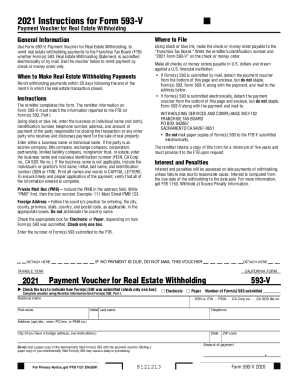

Filling out the CA FTB 593-V, Payment Voucher for Real Estate Withholding, is a crucial step in ensuring timely remittance of real estate withholding payments. This guide provides clear instructions to help users navigate the form easily and efficiently.

Follow the steps to complete your CA FTB 593-V online.

- Click ‘Get Form’ button to retrieve the form and open it in the editor.

- Begin by entering the remitter information. Ensure that the information matches what is reported on Form(s) 593, Part I. Use capital letters for clarity.

- In the business name field, enter either the business name or the individual's name (do not mix both). If applicable, include the appropriate identification number such as SSN, ITIN, or FEIN.

- Fill in the remitter’s telephone number and address. If applicable, include the Private Mail Box (PMB) details, ensuring to write 'PMB' before the box number.

- Indicate whether the Form(s) 593 was submitted electronically or by paper by checking the appropriate box. Only check one box.

- Complete the number of Form(s) 593 submitted to the FTB by entering the correct figure.

- Specify the amount of payment being made. Ensure the payment details are accurate and match the remittance requirement.

- Before completing the process, review all entries for accuracy. Once confirmed, save your changes. You may then choose to download, print, or share the completed form as needed.

Complete your CA FTB 593-V online today to ensure timely processing of your real estate withholding payments.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

A Purpose. Use Form 592-B, to report to the payee the amount of payment or distribution subject to withholding and tax withheld as reported on Form 592, Resident and Nonresident Withholding Statement, or Form 592-F, Foreign Partner or Member Annual Return.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.