Loading

Get Irs 941 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 941 online

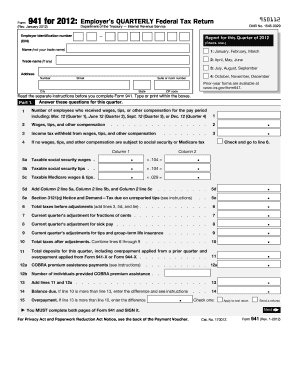

Filing the IRS 941 form is essential for employers to report federal taxes withheld from employee earnings. This guide provides clear and supportive instructions on how to complete this form online, ensuring that all required information is accurately submitted.

Follow the steps to successfully complete the IRS 941 online.

- Click ‘Get Form’ button to obtain the IRS 941 form and access it for online completion.

- Enter your employer identification number (EIN) in the designated box. If you do not have an EIN, you may apply for one online.

- Select the appropriate quarter by checking one of the options provided: January-March, April-June, July-September, or October-December.

- Fill in your business name, trade name (if applicable), and address details including street number, suite or room number, city, state, and ZIP code.

- In Part 1, provide information about the number of employees and their wages, tips, and other compensation for the quarter.

- Complete the fields for income tax withheld, taxable social security wages, and taxable Medicare wages as applicable.

- Add all applicable amounts and make any necessary adjustments for the current quarter, including sick pay and unreported tips.

- Calculate the total taxes before and after adjustments, ensuring all line items are correctly filled out.

- In Part 2, indicate your deposit schedule and provide information regarding your tax liability for the quarter.

- If your business has closed or if you are a seasonal employer, check the relevant boxes in Part 3.

- Complete Part 4 if you wish to designate a third-party to discuss your return with the IRS.

- Sign and date the form in Part 5, certifying that all provided information is true and complete.

- At the end, review your completed form, then save changes, download for your records, and follow any additional instructions for submission and payment, if needed.

Complete your IRS 941 form online today to stay compliant with federal tax requirements.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You need to file IRS Form 941 if you are an employer who pays wages to employees and withholds payroll taxes. Additionally, if you reported taxes during the previous quarter, you are required to file. If you're uncertain, tools like the US Legal Forms platform can help clarify your obligations.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.