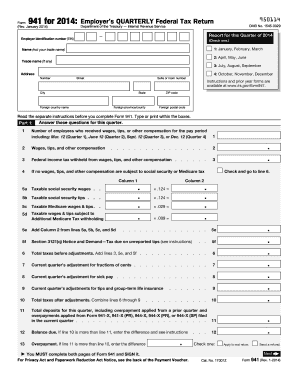

Get Irs 941 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 941 online

How to fill out and sign IRS 941 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you are not affiliated with document management and legal procedures, completing IRS paperwork can be rather overwhelming. We appreciate the importance of accurately filling out documents. Our service provides the capability to make the task of submitting IRS forms as effortless as possible. Follow this instruction to accurately and swiftly file IRS 941.

How you can submit the IRS 941 online:

Utilizing our robust solution will turn proficient filling of IRS 941 into a reality. We will handle everything for your ease and straightforward operation.

Click on the button Get Form to access it and begin editing.

Complete all required fields in the chosen document using our beneficial PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the information provided.

Include the date of completion for IRS 941. Utilize the Sign Tool to create your personal signature for the document validation.

Finish editing by clicking on Done.

Send this document directly to the IRS in the most convenient manner for you: via email, using digital fax, or through postal service.

You can print it on paper if a hard copy is required and download or save it to your preferred cloud storage.

Editing Get IRS 941 2014: Customize Forms Online

Take advantage of the convenience of the versatile online editor while filling out your Get IRS 941 2014. Utilize the variety of tools to swiftly complete the blanks and provide the necessary information without delay.

Preparing documentation can be lengthy and costly unless you have pre-made fillable forms and fill them out electronically. The optimal way to handle the Get IRS 941 2014 is by using our advanced and multifunctional online editing tools. We supply you with all the crucial tools for quick form completion and allow you to make any modifications to your templates to fit various requirements. Additionally, you can leave feedback on the changes and add notes for other parties involved.

Here’s what you can accomplish with your Get IRS 941 2014 in our editor:

Managing Get IRS 941 2014 in our robust online editor is the fastest and most efficient method to organize, submit, and share your documents in the manner you require from anywhere. The tool operates in the cloud, enabling access from any location on any internet-enabled device. All templates you create or fill out are securely stored in the cloud, ensuring you can always retrieve them when needed without the risk of loss. Stop spending time on manual document completion and eliminate paper; handle everything online with minimal effort.

- Fill in the empty fields using Text, Cross, Check, Initials, Date, and Signature tools.

- Emphasize important information with a preferred color or underline them.

- Hide sensitive information with the Blackout feature or simply erase them.

- Add images to illustrate your Get IRS 941 2014.

- Substitute the original text with one that meets your requirements.

- Include comments or sticky notes to communicate updates with others.

- Create additional fillable fields and assign them to specific individuals.

- Secure the document with watermarks, add dates, and bates numbers.

- Distribute the document in various manners and save it on your device or in the cloud in multiple formats post-modification.

Get form

Certain employers, such as those solely using independent contractors, may be exempt from filing the IRS 941 form. Additionally, if your business does not meet certain thresholds, you may not be required to file. Always check with the IRS or use services like US Legal Forms to understand your specific filing obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.