Loading

Get Irs 940-pr 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940-PR online

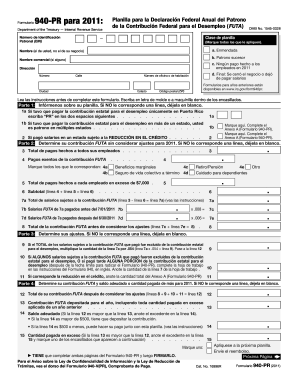

The IRS 940-PR form is essential for employers in Puerto Rico to report their annual Federal Unemployment Tax Act (FUTA) contributions. This guide will assist you through the process of completing the form online, ensuring accurate reporting and compliance with tax requirements.

Follow the steps to fill out the IRS 940-PR online effectively.

- Click ‘Get Form’ button to initiate the process and open the form in your editor.

- Enter your Employer Identification Number (EIN) in the designated field at the top of the form to identify your business.

- Select the appropriate type of form you are submitting (e.g., amended, successor employer, or no payments made to employees) by marking all that apply.

- Complete Part 1 by providing information about your employment tax obligations, ensuring to fill in only the relevant lines.

- For Part 2, calculate your FUTA contribution without adjustments by adding total payments made to all employees and noting any exempt payments.

- In Part 3, determine any adjustments needed based on wages paid and credit reductions. Make sure to calculate and transcribe amounts accurately.

- Complete Part 4 by summing your total FUTA contribution after adjustments and comparing it with any contributions previously deposited.

- Fill out Part 5 if you have to report your FUTA liability for each quarter, ensuring the total aligns with the calculations in Part 4.

- In Part 6, indicate whether you allow a third party to discuss the form with the IRS by selecting yes or no.

- Finally, in Part 7, sign and date the form, certifying that the information provided is complete and accurate. Make sure to print your name and provide your phone number.

- After completing the form, review all entries for accuracy and clarity. You can then save your changes, download a copy, print it out, or share it as needed.

Complete your IRS 940-PR online to ensure timely and accurate tax reporting.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file IRS Form 940 online through various tax software platforms and services. Filing online expedites the processing time and helps you maintain accurate records. Utilizing solutions such as US Legal Forms can simplify the online filing experience and ensure compliance with IRS requirements.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.