Loading

Get Irs 940-pr 2012

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940-PR online

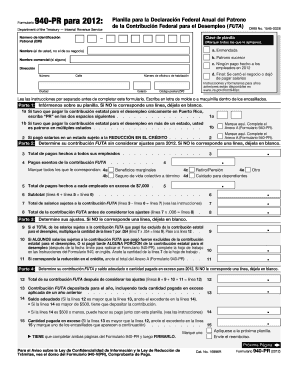

Filling out the IRS 940-PR form can seem challenging, especially for those unfamiliar with tax documentation. This guide provides a step-by-step approach to help users complete the form accurately and efficiently, ensuring compliance with federal requirements.

Follow the steps to successfully complete the IRS 940-PR form online.

- Press the ‘Get Form’ button to access the IRS 940-PR form. Open it in your editor for easier filling.

- Begin with Part 1 by providing your employer identification number (EIN) and marking the applicable checkbox indicating if the form is amended, if you are a successor employer, or if no payments were made to employees in 2012.

- In Part 1, enter your name and business name, if applicable. Make sure to include your address, including city, state, and ZIP code.

- Proceed to Part 2 to determine your FUTA contribution. In line 3, total the payments made to all employees. In line 4, account for any exempt payments.

- Calculate your total taxable wages by subtracting the subtotal from line 4 from the total on line 3 to determine line 7. Then, multiply the result by the applicable FUTA rate to find line 8.

- Move to Part 3 and make any adjustments as necessary. Follow the instructions provided for lines 9 through 11 to ensure the correct calculations are made.

- In Part 4, sum all contributions and adjust for any amounts owed. Record your total contribution on line 12 and check the payment against line 13.

- If applicable, complete Part 5 by reporting your quarterly FUTA liabilities, if they exceed $500.

- In Part 6, decide if you want to authorize a third party to discuss your form with the IRS, entering their name and phone number if yes.

- Finally, ensure you sign and date the form in Part 7, declaring that all information is true and complete as required.

- After completing both pages of the form, save your changes and choose to download, print, or share the document as needed.

Start filling out the IRS 940-PR online today to meet your tax obligations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Yes, you can file IRS Form 940 online. Many platforms support e-filing, making it more convenient and efficient. By choosing uslegalforms, you gain access to an easy-to-navigate tool that ensures your form is submitted accurately and on time.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.