Loading

Get Irs 940 - Schedule R 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940 - Schedule R online

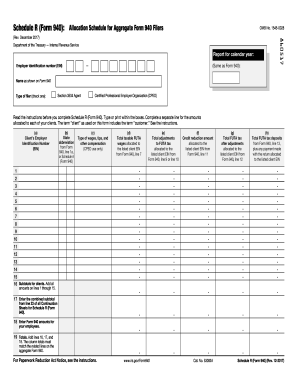

Filling out the IRS 940 - Schedule R is essential for agents managing multiple home care service clients. This guide provides clear and supportive instructions for completing the form accurately to ensure compliance with IRS regulations.

Follow the steps to efficiently complete your Schedule R

- Press the ‘Get Form’ button to access the IRS 940 - Schedule R and open it in the document editor.

- Carefully enter your employer identification number (EIN) and the name of your business at the top of the form. These details must match exactly with what is on your accompanying Form 940.

- Indicate the calendar year for which you're filing. Ensure that this matches the year reported on Form 940.

- For each client, complete a separate line stating the following: their EIN, state abbreviation, total taxable FUTA wages (from Form 940, line 7), adjustments to FUTA tax (from Form 940, line 9 or line 10), credit reduction amount (from Form 940, line 11), total FUTA tax after adjustments (from Form 940, line 12), and total FUTA tax deposits (from Form 940, line 13).

- If you have more than 15 clients, utilize the continuation sheets as necessary, ensuring to include subtotal data in your main Schedule R.

- Compare the totals on line 19 with the related amounts on your Form 940. Ensure each column total matches; if they do not, correct any discrepancies before submission.

- Once completed, review your Schedule R for accuracy, then save any changes, and either print or save the document for your records.

Complete your Schedule R online to ensure proper handling of your tax duties.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

Whether you need to file Schedule R depends on your tax situation. If you are 65 or older and have qualified pension income, filing IRS 940 - Schedule R can help you claim important credits. Review your retirement income and consult platforms like US Legal Forms for assistance in determining your filing needs.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.