Get Irs 940 - Schedule R 2017-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940 - Schedule R online

This guide provides a comprehensive overview of how to complete the IRS 940 - Schedule R online. You will find clear, step-by-step instructions to ensure accurate reporting for your clients and compliance with IRS regulations.

Follow the steps to successfully fill out Schedule R.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

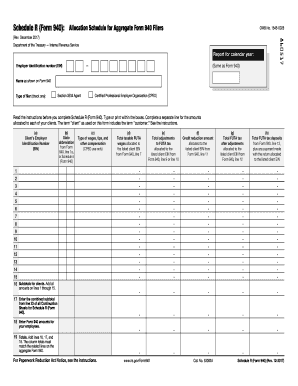

- Enter your business information at the top of Schedule R. Ensure the employer identification number (EIN) and business name match exactly with those on the attached Form 940. Check the appropriate box to specify if you are a section 3504 agent or a certified professional employer organization (CPEO).

- Indicate the calendar year for which you are filing the form at the top of Schedule R, making sure it matches the year on the attached Form 940.

- Report the following information for each client: (a) Client’s employer identification number (EIN). (b) State abbreviation based on Form 940, line 1a, or Schedule A. (c) Type of wages, tips, and other compensation (for CPEO use only) using the appropriate codes. If reporting multiple types for a client, complete one line for each type.

- For each client, complete the following columns: (d) Total taxable FUTA wages from Form 940, line 7. (e) Total adjustments to FUTA tax from Form 940, line 9 or 10. (f) Credit reduction amount from Form 940, line 11. (g) Total FUTA tax after adjustments from Form 940, line 12. (h) Total FUTA tax deposits from Form 940, line 13.

- If you have more clients than available lines, complete as many continuation sheets as necessary. Ensure to report the same information for your employees on Schedule R, line 18.

- After filling out the form, add the totals from lines 16, 17, and 18 to find the totals for line 19. Ensure that these totals match the related lines on the aggregate Form 940.

- Once all information is accurate and complete, you can save your changes, download, print, or share the form as required.

Complete your IRS 940 - Schedule R online today to ensure compliance and accurate reporting.

IRS Schedule R is used for claiming the Credit for the Elderly or the Disabled by qualifying taxpayers. This form helps lower your tax burden by providing credits based on your age and income level, making it an essential part of financial planning for many seniors. Understanding how to utilize IRS 940 - Schedule R can significantly impact your tax savings. For detailed instructions and helpful insights, consider exploring USLegalForms’ extensive collection of resources.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.