Loading

Get Irs 940 - Schedule A 2011

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 940 - Schedule A online

This guide provides a clear and supportive framework for filling out the IRS 940 - Schedule A online. It is designed to assist users with varying levels of experience in navigating the form and ensuring accurate completion.

Follow the steps to successfully complete Schedule A online.

- Click ‘Get Form’ button to access the form and open it in the editing interface.

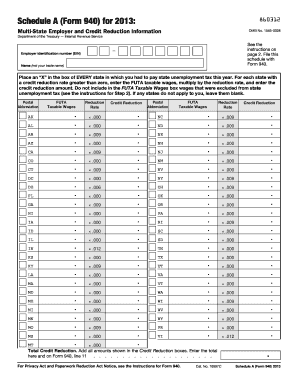

- Review the postal abbreviations for the states and territories listed on the form. Mark an 'X' in the box for each state where you are required to pay state unemployment tax this year, including those with a zero credit reduction rate.

- In the FUTA Taxable Wages box, enter the total FUTA taxable wages that you have paid in each state listed. Remember not to include any wages that were excluded from state unemployment tax.

- For each state that has a credit reduction, multiply the FUTA taxable wages you entered by the respective reduction rate for that state. Enter this amount in the Credit Reduction box for each state.

- To calculate the total credit reduction, sum all amounts from the Credit Reduction boxes. Enter this total in the Total Credit Reduction box.

- Make sure to also enter the total credit reduction amount on Form 940, line 11 before proceeding to save, download, or share your completed form.

Complete your IRS 940 - Schedule A online today for an efficient filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

The mailing address for your 940 FUTA tax return depends on whether you are sending your return with a payment. If you are mailing without a payment, you can send it to the address specified in the IRS Form 940 instructions. Ensuring you send it to the correct address is essential to avoid processing delays. For comprehensive instructions, visit IRS 940 - Schedule A for guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.