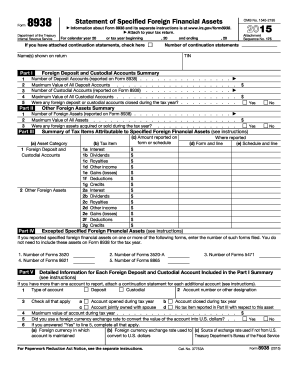

Get Irs 8938 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8938 online

How to fill out and sign IRS 8938 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity. Follow the simple instructions below:

When people aren’t linked to document management and legal processes, submitting IRS documents can be quite challenging. We recognize the importance of accurately completing paperwork. Our online application provides the solution to simplify the process of filing IRS documents as much as possible. Follow these recommendations to effectively and swiftly submit IRS 8938.

The most effective way to complete the IRS 8938 online:

Using our online application will enable professional completion of IRS 8938. We will ensure everything is done for your ease and simplicity.

Click the button Get Form to access it and begin editing.

Fill in all necessary fields in your document using our expert PDF editor. Activate the Wizard Tool to make the process even easier.

Verify the accuracy of the entered information.

Add the date of submission for IRS 8938. Utilize the Sign Tool to create a personalized signature for document validation.

Conclude editing by clicking on Done.

Send this document to the IRS in the most convenient manner for you: via email, virtual fax, or postal service.

You have the option to print it out on paper when a copy is needed and download or save it to your chosen cloud storage.

How to modify Get IRS 8938 2015: personalize forms digitally

Put the appropriate document management features at your disposal. Execute Get IRS 8938 2015 with our reliable tool that integrates editing and eSignature capabilities.

If you wish to finalize and sign Get IRS 8938 2015 online effortlessly, then our online cloud-driven solution is the ideal choice. We provide a comprehensive template library of ready-to-use documents that you can modify and complete online. Furthermore, there is no need to print the document or employ external tools to make it fillable. All necessary tools will be accessible for your utilization as soon as you access the document in the editor.

Let’s explore our online editing features and their primary functionalities. The editor boasts an intuitive interface, so it won’t take a lot of time to become acquainted with it. We’ll review three key components that enable you to:

In addition to the aforementioned features, you can protect your document with a password, apply a watermark, convert the document to the required format, and much more.

Our editor simplifies adjusting and certifying the Get IRS 8938 2015. It allows you to do virtually everything related to document handling. Additionally, we consistently ensure that your experience with files is secure and compliant with major regulatory standards. All these elements make utilizing our solution even more pleasant.

Obtain Get IRS 8938 2015, implement the necessary modifications and alterations, and download it in your preferred file format. Try it out today!

- Modify and annotate the template

- The top toolbar includes tools that assist you in highlighting and blacking out text, excluding images and visual elements (lines, arrows, and checkmarks, etc.), adding your signature, initializing, dating the form, and more.

- Arrange your documents

- Utilize the left-side toolbar if you want to rearrange the form or delete pages.

- Make them shareable

- If you aim to render the document fillable for others and distribute it, you can utilize the tools on the right to incorporate various fillable fields, signatures and dates, text boxes, etc.

Get form

Eligibility to file IRS 8938 generally includes U.S. citizens, resident aliens, and certain non-resident aliens. If your foreign financial assets exceed the established thresholds, you must file. Being aware of who qualifies helps ensure you meet your obligations without overlooking critical details.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.