Get Irs 8917 2012

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8917 online

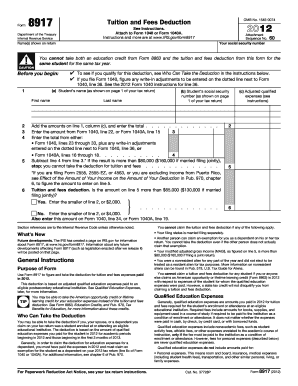

Filling out the IRS Form 8917, which pertains to the tuition and fees deduction, is an important step in claiming educational expenses for tax purposes. This guide provides clear and supportive instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the IRS 8917 online.

- Click the ‘Get Form’ button to obtain the IRS Form 8917 and open it in your preferred online editor.

- Begin by entering your social security number and the name(s) shown on your tax return in the designated fields.

- Indicate the student's name and social security number as it appears on your tax return. Fill in their adjusted qualified education expenses in column (c).

- Add the amounts listed in line 1, column (c), for all qualifying students, and enter the total amount on line 2.

- Next, refer to your Form 1040 or Form 1040A to complete line 3 by entering the appropriate amount from line 22 or line 15.

- For line 4, compute the amount by subtracting line 3 from line 2. If the result exceeds $80,000 (or $160,000 if married filing jointly), you are ineligible for the deduction.

- Complete line 5 based on whether the amount on line 5 is more than $65,000 (or $130,000 if married filing jointly), and enter the smaller of line 2 or $2,000 or $4,000 on the appropriate line.

- Once you have filled in all relevant sections, review your entries for accuracy. Save your progress, and proceed to download, print, or share your completed Form 8917 as needed.

Complete your IRS 8917 form online today and ensure your tuition and fees deduction is properly claimed.

Get form

The 1098-T form is typically issued by the educational institution to either the student or the parent who pays for the qualified education expenses. If a parent claims the student as a dependent, the parent may use the information from the 1098-T to claim potential education benefits on their tax return. It's crucial to understand who receives this form, as it affects how you report educational expenses on your return. Consulting resources from USLegalForms can assist in navigating these requirements.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.