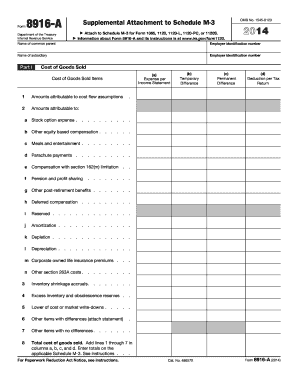

Get Irs 8916-a 2014

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8916-A online

How to fill out and sign IRS 8916-A online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked with document management and legal procedures, submitting IRS forms can be quite daunting. We fully understand the importance of correctly filling out documents. Our service provides a method to simplify the process of handling IRS forms as much as possible.

Follow this guide to precisely and swiftly fill out IRS 8916-A.

Utilizing our service will transform professional filling of IRS 8916-A into reality. We will handle everything for your ease and swift completion.

Hit the button Get Form to access it and begin editing.

Complete all required fields in the form with our easy-to-use PDF editor. Activate the Wizard Tool to make the process much easier.

Ensure the accuracy of the entered information.

Include the date of completing IRS 8916-A. Utilize the Sign Tool to create your signature for document validation.

Conclude editing by clicking Done.

Send this document directly to the IRS in the most convenient method for you: via email, using virtual fax, or postal mail.

You can print it on paper if a physical copy is necessary and download or save it to your chosen cloud storage.

How to modify Get IRS 8916-A 2014: tailor forms online

Locate the appropriate Get IRS 8916-A 2014 template and amend it instantly.

Streamline your documentation with an intelligent document editing tool for online forms.

Your daily processes with documents and forms can become more efficient when you have everything at your disposal in one location. For instance, you can search for, acquire, and adjust Get IRS 8916-A 2014 in a single browser tab. If you require a specific Get IRS 8916-A 2014, you can quickly locate it using the advanced search engine and access it immediately. There's no need to download it or look for an external editor to modify it and add your information. All the resources for productive work come in a unified package.

This editing tool enables you to customize, complete, and endorse your Get IRS 8916-A 2014 form directly on the spot. Once you find an appropriate template, click on it to enter the editing mode. After opening the form in the editor, you'll have all the essential tools within reach. It’s straightforward to fill in the designated fields and remove them if necessary using a simple yet versatile toolbar. Implement all modifications instantly, and sign the form without navigating away from the tab by merely clicking the signature field. Subsequently, you can either send or print your document if needed.

Uncover new possibilities for efficient and hassle-free paperwork. Locate the Get IRS 8916-A 2014 you require in just minutes and complete it in the same tab. Eliminate confusion in your paperwork once and for all with the assistance of online forms.

- Make additional tailored edits with the available tools.

- Comment on your document using the Sticky note feature by placing a note at any location within the file.

- Incorporate necessary visual elements, if needed, with the Circle, Check, or Cross tools.

- Alter or insert text anywhere in the document using Texts and Text box tools. Include information with the Initials or Date feature.

- Revise the template text using the Highlight and Blackout, or Erase tools.

- Introduce custom visual elements using the Arrow and Line, or Draw tools.

Get form

A tax return reconciliation worksheet is a tool designed to assist you in comparing your tax filings against IRS records. By using this worksheet, you can identify any inconsistencies that need to be addressed, ensuring accurate reporting. Forms like the IRS 8916-A may also be necessary to consider when claiming premium tax credits.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.