Loading

Get Irs 8889 2013

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8889 online

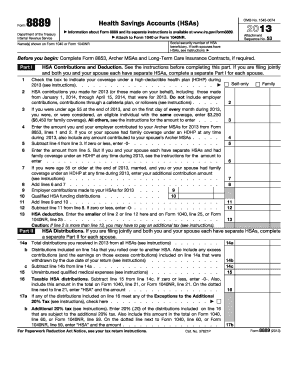

Filling out the IRS 8889 form is essential for individuals with Health Savings Accounts (HSAs) to report contributions and distributions. This guide provides step-by-step instructions to complete the form efficiently online.

Follow the steps to successfully complete the IRS 8889 form online.

- Click ‘Get Form’ button to obtain the form and open it in your selected editor.

- Begin by entering your name and social security number as they appear on Form 1040 or Form 1040NR.

- Complete Part I by checking the box to indicate your coverage under a high-deductible health plan during the tax year.

- Input the total HSA contributions you made for the year, including anything contributed on your behalf up to the relevant deadline.

- If applicable, enter the contribution limits based on your age and coverage type, utilizing the instructions provided to calculate accurately.

- Proceed to Part II to report total distributions received from your HSAs. Be sure to detail any amounts rolled over or excess contributions withdrawn.

- Complete Part III to detail any additional income and taxes relevant to the failure to maintain HDHP coverage.

- Review all entered information for accuracy. Once verified, save changes, download, print, or share your completed form as necessary.

Complete your IRS 8889 form online today to ensure compliance and take advantage of your Health Savings Account benefits.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, you must report your HSA on your tax return if you made contributions or received distributions. IRS form 8889 is the designated form for reporting this critical information. Failing to report your HSA correctly can lead to unintended tax liabilities or loss of potential tax benefits. Using tools like US Legal Forms can help you navigate this process smoothly.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.