Loading

Get Irs 8879-eo 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-EO online

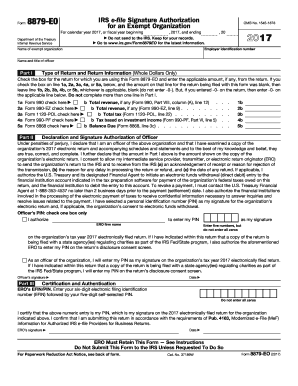

The IRS 8879-EO is a critical form used by exempt organizations to authorize the electronic filing of their returns. In this guide, you will learn how to complete the form accurately and easily online, ensuring compliance and proper documentation.

Follow the steps to fill out the IRS 8879-EO effectively.

- Click 'Get Form' button to initiate the process and obtain the IRS 8879-EO form available for online completion.

- Enter the employer identification number (EIN) of the exempt organization in the designated field at the top of the form.

- Provide the name of the exempt organization and the name and title of the officer authorized to sign the form.

- In Part I, check the appropriate box to indicate the type of return being filed. Enter the applicable amount from the electronic return, if applicable. Ensure that only one line is completed in this section.

- Move to Part II and fill out the total revenue information as required based on the return type checked in Part I. Make sure you are accurate with these figures.

- In the declaration section, affirm the accuracy of the information provided and declare your consent for the electronic return submission. Enter your personal identification number (PIN) to act as your electronic signature.

- Complete any necessary additional information required by the ERO (Electronic Return Originator), such as the ERO's electronic filing identification number (EFIN) and PIN.

- After completing the form, you can save your changes, download a copy for your records, print it, or share it as needed.

Start filling out your IRS 8879-EO form online for a smooth electronic filing process.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS form 8879-EO is specifically designed for Exempt Organizations to authorize e-filing of Form 990 series returns. This form plays a vital role in the electronic submission process, confirming that the taxpayer approves the filing and is aware of the contents. Utilizing uslegalforms to manage IRS 8879-EO can streamline your filing, ensuring compliance and efficiency.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.