Loading

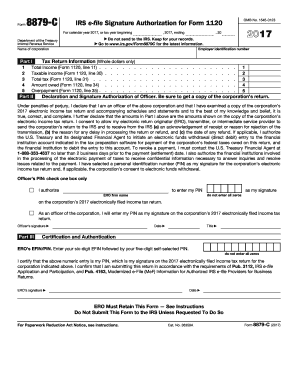

Get Irs 8879-c 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8879-C online

Filling out the IRS 8879-C is an essential step for corporate officers who need to electronically sign a corporation's income tax return. This guide provides clear, step-by-step instructions to help you complete the form accurately and efficiently.

Follow the steps to successfully complete the IRS 8879-C form online.

- Click the ‘Get Form’ button to access the IRS 8879-C form and open it in your preferred online editor.

- Enter the corporation's employer identification number and name at the top of the form. Ensure this information matches what is reported in the corporation’s tax return.

- In Part I, provide the required tax return information. Fill in whole dollar amounts for total income (line 11), taxable income (line 30), total tax (line 31), amount owed (line 34), and overpayment (line 35) as applicable.

- In Part II, declare the officer's authorization. The corporate officer must sign, date, and enter their title. They should also select how their personal identification number (PIN) will be entered, either by authorizing the ERO to do so or entering it themselves.

- For Part III, the ERO will enter their EFIN and self-selected PIN. The ERO must also sign and date this section, confirming they are submitting the return according to IRS guidelines.

- Once all sections are completed and reviewed, save the changes made to the form. Users can choose to download, print, or securely share the form with relevant parties.

Complete your IRS 8879-C form online today to ensure timely submission and compliance.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

IRS Schedule C is used by sole proprietors to report income and expenses related to their business activities. This form allows you to calculate profit or loss from your business, which is then transferred to your personal tax return. If you are e-filing with IRS 8879-C, make sure to include your Schedule C information accurately. This ensures that your tax filings reflect your actual financial situation.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.