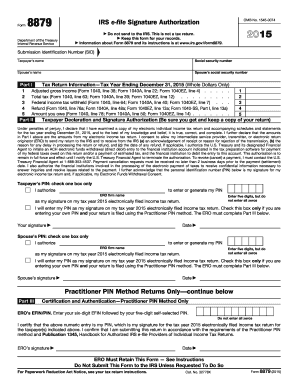

Get Irs 8879 2015

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8879 online

How to fill out and sign IRS 8879 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked to document control and legal procedures, filling out IRS forms can be surprisingly tiring. We completely understand the importance of accurately completing documents.

Our online application offers the capability to simplify the process of submitting IRS documents as much as possible.

Using our service will turn the professional filling of IRS 8879 into a reality, making everything more comfortable and secure for your work.

- Click on the button Get Form to access it and begin editing.

- Complete all required fields in the chosen document using our beneficial PDF editor. Activate the Wizard Tool to make the task even simpler.

- Verify the accuracy of the entered information.

- Add the date of submitting IRS 8879. Employ the Sign Tool to create a distinct signature for document authorization.

- Conclude your modifications by clicking Done.

- Send this document to the IRS in the most convenient way for you: via email, using digital fax, or traditional mail.

- You can print it on paper when a copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 8879 2015: personalize forms online

Experience the convenience of the feature-rich online editor while finalizing your Get IRS 8879 2015. Utilize the array of tools to swiftly complete the blank sections and deliver the required information immediately.

Preparing paperwork is laborious and costly unless you have pre-made fillable forms and complete them digitally. The best method to handle the Get IRS 8879 2015 is to utilize our expert and multifunctional online editing tools. We provide you with all the essential resources for rapid document completion and allow you to make any modifications to your templates, tailoring them to any specifications. Furthermore, you can add remarks on the adjustments and leave notes for other participants involved.

Here’s what you can accomplish with your Get IRS 8879 2015 in our editor:

Managing Get IRS 8879 2015 in our sturdy online editor is the quickest and most productive way to organize, submit, and share your documents according to your requirements from anywhere. The tool operates from the cloud, allowing you to access it from any location on any internet-enabled device. All templates you create or prepare are securely stored in the cloud, so you can always retrieve them as needed and remain confident about not losing them. Stop wasting time on manual document completion and eliminate paperwork; accomplish everything online with minimal effort.

- Complete the blank areas using Text, Cross, Check, Initials, Date, and Sign options.

- Emphasize important information with a preferred color or underline them.

- Mask sensitive information using the Blackout feature or simply eliminate them.

- Insert images to illustrate your Get IRS 8879 2015.

- Replace the original content with one that corresponds to your needs.

- Add remarks or sticky notes to converse with others regarding the modifications.

- Create extra fillable fields and designate them to specific recipients.

- Secure the document with watermarks, place dates, and bates numbers.

- Distribute the document in various formats and save it on your device or in the cloud after you finish editing.

Get form

Related links form

You do not send the IRS form 8879 to the IRS as a standalone document. Instead, it is retained by your tax preparer and provided only upon request by the IRS. Be sure to keep communication open with your tax professional to ensure proper handling of this form.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.