Get Irs 8867 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8867 online

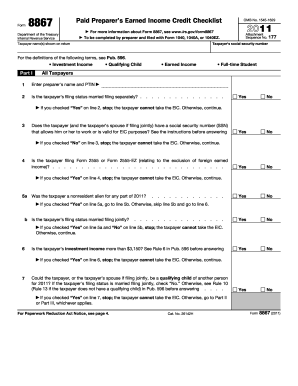

Filling out the IRS 8867 form online is an essential step for tax preparers to ensure that taxpayers claiming the earned income credit meet all eligibility requirements. This guide provides a clear and concise approach to navigating the form’s components and completing it accurately.

Follow the steps to successfully complete the IRS 8867 form online.

- Click ‘Get Form’ button to access the IRS 8867 form and open it in the editor.

- Enter the preparer’s name and PTIN in the first field to identify who is completing the form.

- Indicate whether the taxpayer’s filing status is married filing separately. If 'Yes,' stop; the taxpayer cannot take the earned income credit (EIC).

- Check if the taxpayer is filing Form 2555 or 2555-EZ. If 'Yes', stop; the taxpayer cannot take the EIC.

- Confirm that the taxpayer and their spouse (if filing jointly) have valid SSNs for work or valid for EIC. If 'No', stop; the taxpayer cannot take the EIC.

- Determine if the taxpayer was a nonresident alien for any part of the year. If 'Yes' and married filing jointly, stop; the taxpayer cannot take the EIC.

- Evaluate if the taxpayer’s investment income exceeds $3,150. If 'Yes', stop; the taxpayer cannot take the EIC.

- Assess whether the taxpayer or their spouse could be a qualifying child of another person. If 'Yes', stop; the taxpayer cannot take the EIC.

- For taxpayers with children, complete sections pertaining to the child, such as their relationship to the taxpayer, SSN validity, and whether they lived with the taxpayer for over half the year.

- Confirm if the taxpayer’s earned income and adjusted gross income are below the applicable limit for 2011. If 'No', stop; the taxpayer cannot take the EIC.

- If applicable, ensure all due diligence records are kept, including form 8867 and relevant worksheets.

- Once all fields are accurately filled out, users can choose to save changes, download, print, or share the completed form.

Complete your IRS 8867 form online today to ensure compliance and maximize your tax benefits.

Get form

You can obtain an IRS instruction booklet through the official IRS website or directly from your local IRS office. These booklets provide comprehensive details about various forms including IRS 8867 and can guide you in filling them out properly. Many tax software programs also provide access to these instructions online. If you're unsure, platforms like USLegalForms can simplify the process by providing easy access to necessary documents and instructions.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.