Loading

Get Irs 8867 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8867 online

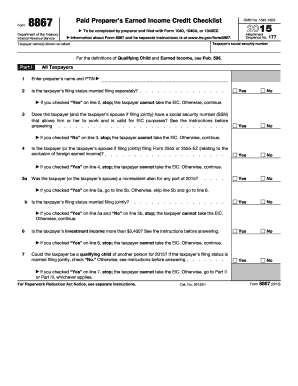

The IRS 8867 form, known as the Paid Preparer's Earned Income Credit Checklist, is essential for tax preparers to ensure that their clients qualify for the Earned Income Credit (EIC). This guide will provide comprehensive step-by-step instructions for filling out the IRS 8867 online, making the process straightforward and accessible for all users.

Follow the steps to successfully complete IRS 8867 online.

- Click the ‘Get Form’ button to obtain the IRS 8867 form and open it in your document editor.

- Enter the preparer’s name and Preparer Tax Identification Number (PTIN) in the spaces provided at the top of the form.

- For question 2, determine the taxpayer's filing status. If the taxpayer is married filing separately, select 'Yes'; otherwise, select 'No' and you will need to stop here as they cannot take the EIC.

- Proceed to question 3 and check if either the taxpayer or the spouse is filing Form 2555 or 2555-EZ. Respond 'Yes' or 'No' accordingly. A 'Yes' answer disqualifies the EIC eligibility.

- In question 4, confirm if the taxpayer and their spouse have valid social security numbers for work. They must select the appropriate response, as a 'No' response prohibits the EIC.

- Question 5 assesses whether the taxpayer or spouse was a nonresident alien at any point in the year. Depending on their response, follow the form’s guidance.

- Continue with the investment income question (question 6). If their investment income exceeds $3,400, they will not qualify for the EIC.

- Question 7 inquires if the taxpayer could be a qualifying child for another person. This requires careful consideration, as a 'Yes' response may disqualify the taxpayer from EIC if they do not file jointly with their spouse.

- For taxpayers with children, complete Part II. Begin by entering the child's name in question 8 and answering subsequent questions on the child's relationship to the taxpayer, marital status, and living situation.

- If addressing more than one child, ensure all questions from 8 to 14 are completed for each child before proceeding.

- In Part III, for taxpayers without a qualifying child, answer questions about residency and age to determine eligibility for the EIC.

- Move to Part IV, where the preparer confirms due diligence by answering questions related to the completeness and accuracy of the information received.

- Finally, review the responses to ensure all sections are complete. Users may now save changes, download, print, or share the completed form.

Complete your IRS filings accurately by filling out the IRS 8867 and other necessary documents online today.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

If you fail to submit form IRS 8867, the penalties can be quite serious. This can result in missed tax credits and possibly monetary fines for each instance of non-compliance. Being proactive and filing the form correctly helps safeguard your financial interests.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.