Loading

Get Irs 8843 2017

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8843 online

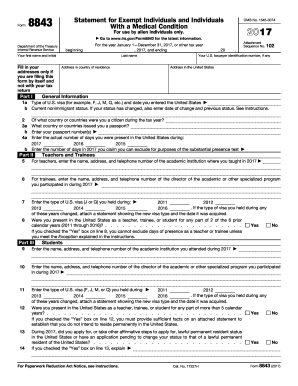

The IRS 8843 is a crucial form used by certain nonresident aliens to explain their status and claim exemptions from the substantial presence test. This guide provides clear, step-by-step instructions for completing the form online, ensuring that users can navigate the process with ease.

Follow the steps to fill out the IRS 8843 online

- Click ‘Get Form’ button to access the IRS 8843 form and open it for editing.

- Fill in your personal information in Part I, including your first name, last name, addresses, and taxpayer identification number, if applicable. Make sure to provide your current nonimmigrant status.

- In Part I, indicate the type of U.S. visa you hold and the date you entered the United States. Additionally, provide information about your citizenship and passport details.

- Proceed to fill in the number of days you were physically present in the United States for the current year and the two preceding years.

- If you are a teacher or trainee, complete Part II by entering the name, address, and contact details of your academic institution. Provide additional information as required.

- For students, document the name and contact information of the academic institution you attended in Part III, and include similar details regarding any previous years of presence in the U.S.

- Complete Part IV if you are a professional athlete, entering details about the charitable sports events you participated in during the year.

- If applicable, fill out Part V regarding any medical conditions that prevented you from leaving the United States, and provide a physician's statement.

- Once all sections of the form are completed, review your information for accuracy.

- Save changes to your completed form, and utilize options available for downloading, printing, or sharing the form as needed.

Take action now and complete your IRS 8843 form online to ensure compliance with tax regulations.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Generally, you can only claim a 20-year-old as a dependent if they qualify under the IRS rules, which typically require them to be a full-time student or meet specific financial criteria. If they do not meet these conditions, you cannot claim them. Understanding the dependencies and forms, like the IRS 8843, is vital to ensuring compliance with tax laws.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.