Loading

Get Irs 8829 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8829 online

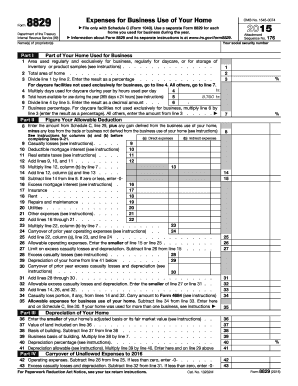

Filing the IRS Form 8829 is essential for claiming expenses related to the business use of your home. This guide will provide clear, step-by-step instructions to ensure you complete the form accurately and efficiently, even if you're new to the process.

Follow the steps to successfully complete the IRS 8829 form online.

- Click ‘Get Form’ button to obtain the form and open it in an online editor.

- Begin by completing Part I, which requires you to enter the area of your home used regularly and exclusively for business (line 1) and the total area of your home (line 2). This information is vital as it determines the percentage of your home that can be used for business deductions.

- Calculate the business use percentage by dividing the area from line 1 by the total area in line 2 (line 3). If your home is also used for daycare, follow the additional lines provided to assess the appropriate metrics.

- Move to Part II to fill in direct and indirect expenses. For direct expenses, details regarding line numbers 7 to 15 should be input accurately, reflecting costs that are solely for business use.

- Next, you will enter any depreciation related to your home on lines 36 through 40. This includes the adjusted basis or fair market value of your home and related calculations to determine the depreciation allowable.

- In Part IV, record your casualty losses and the associated expenses. You will need to sum up costs and apply the business use percentage to calculate the deductible amount for the business use of your home.

- Ensure that all necessary fields are completed and review your entries. Make any adjustments as needed to ensure accuracy.

- Once you have verified all your inputs, proceed to save changes, download, print, or share the form as required for your records.

Start filling out the IRS 8829 form online today to ensure you maximize your eligible deductions.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To claim home office space on your taxes, you need to complete IRS Form 8829 accurately. You must ensure that your home office qualifies by being your principal place of business or a space used regularly for business purposes. By submitting Form 8829 along with your tax return, you can successfully deduct expenses related to your home office and maximize your savings.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.