Loading

Get Irs 8804 - Schedule A 2015

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8804 - Schedule A online

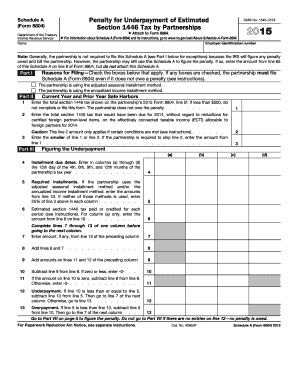

Filling out the IRS 8804 - Schedule A can seem daunting, but with clear guidance, you can navigate the process online effectively. This guide provides a step-by-step approach to help you successfully complete the form.

Follow the steps to fill out the form accurately and efficiently.

- Click ‘Get Form’ button to obtain the form and open it for editing.

- Enter the name of the partnership in the designated field at the top of the form.

- Provide the employer identification number (EIN) associated with the partnership.

- In Part I, check the boxes that apply regarding the reasons for filing to determine if the partnership must submit Schedule A.

- Proceed to Part II and enter the total section 1446 tax from line 5f of the partnership’s 2015 Form 8804. If this amount is less than $500, do not continue with the form.

- Complete the appropriate fields to determine safe harbors for the current year and prior year tax obligations.

- In Part III, input the installment due dates and required installments, accurately reflecting the payments made or credited during the tax year.

- Follow through with the calculations in lines 6 to 13 to determine any underpayments or overpayments.

- Continue to Part IV or Part V if applicable to choose the adjusted seasonal installment method or the annualized income installment method, providing all necessary details.

- Finish by reviewing all entries for accuracy, ensuring all calculations are correct and properly documented.

- Once complete, users can save changes, download, print, or share the form as needed.

Start filling out your IRS 8804 - Schedule A online today for a smoother filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Yes, if you need more time to file your IRS form 8804, you must request a separate extension. The extension process is distinct and must be completed in a timely manner to avoid penalties. It is crucial to follow IRS instructions carefully when applying for an extension. For assistance with this process, consider consulting the US Legal Forms platform for reliable resources and guidance.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.