Loading

Get Irs 8801 Instructions 2013

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8801 Instructions online

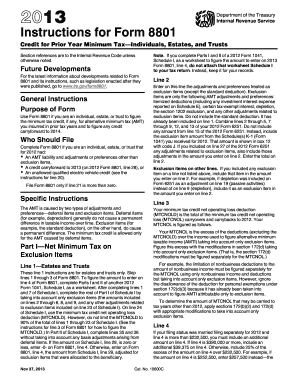

Filling out the IRS 8801 Instructions is an essential step for individuals, estates, or trusts seeking to determine the minimum tax credit for alternative minimum tax incurred in prior years. This comprehensive guide provides clear and supportive instructions to help users navigate each section effectively.

Follow the steps to complete the IRS 8801 form online:

- Click ‘Get Form’ button to obtain the form and open it in the online editor.

- Review the purpose of the form to understand if you qualify to file. Use Form 8801 if you have an alternative minimum tax liability or credit carryforward from the previous year.

- Begin filling out Part I. For estates and trusts, complete lines using the 2012 Form 1041 Schedule I as a worksheet, ensuring that only exclusion items are considered for the calculations.

- On line 2, enter the exclusion items; include only those AMT adjustments and preferences specified in the instructions.

- For line 3, calculate your minimum tax credit net operating loss deduction. This will involve determining the excess of your deductions over the income used to determine alternative minimum taxable income.

- If filing status is married filing separately and line 4 exceeds certain thresholds, include additional amounts as specified in the instructions.

- Progress to Part II, where you will calculate your credit carryforward to 2014 based on lines 28, 29, and 30, adjusting for any applicable credits.

- Finally, ensure all required lines are completed accurately, then review your entries for correctness before submitting. You can save changes, download, print, or share the filled-out form as needed.

Prepare your IRS 8801 form online today to ensure your tax credits are accurately processed.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Certain municipal bonds, often referred to as 'private activity bonds,' are exempt from AMT. These bonds typically provide tax-exempt interest, which can be beneficial if you understand their implications. For a comprehensive understanding, refer to the IRS 8801 Instructions to ensure you manage your investments wisely.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.