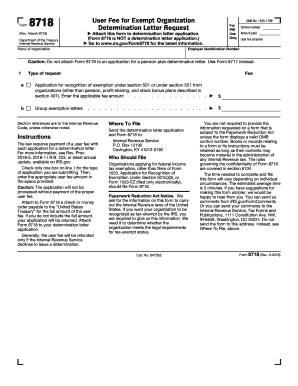

Get Irs 8718 2018-2025

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 8718 online

How to fill out and sign IRS 8718 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If you aren't linked with document management and legal processes, completing IRS forms will be quite challenging. We understand the importance of accurately filling out forms. Our online application provides the solution to simplify the procedure of submitting IRS forms as much as possible. Adhere to these instructions to properly and swiftly fill out IRS 8718.

How to file the IRS 8718 online:

Utilizing our robust solution can certainly facilitate the expert completion of IRS 8718. Make everything for your efficient and swift work.

Press the button Get Form to access it and begin editing.

Complete all mandatory fields in your document using our user-friendly PDF editor. Activate the Wizard Tool to make the process considerably easier.

Verify the accuracy of the submitted information.

Include the date of submission for IRS 8718. Use the Sign Tool to create your personal signature for document validation.

Conclude editing by selecting Done.

Transmit this file to the IRS in the most convenient manner for you: via email, using digital fax, or postal service.

You can print it out on paper if a physical copy is needed and download or save it to your preferred cloud storage.

How to modify Get IRS 8718 2018: personalize forms online

Sign and distribute Get IRS 8718 2018 along with any additional business and personal documents online without squandering time and resources on printing and mailing. Optimize your experience with our online form editor featuring an embedded compliant electronic signature tool.

Signing and submitting Get IRS 8718 2018 forms electronically is quicker and more efficient than handling them on paper. However, it necessitates utilizing online services that guarantee a high level of data protection and provide you with a compliant tool for creating electronic signatures. Our powerful online editor is precisely what you require to finalize your Get IRS 8718 2018 and other personal or business tax templates accurately and appropriately, in line with all obligations. It supplies all the essential tools to effortlessly and swiftly complete, amend, and endorse documents online and include Signature fields for others, indicating who must sign and where.

It takes only a handful of straightforward steps to fill out and endorse Get IRS 8718 2018 online:

Share your document with others using one of the available methods. When signing Get IRS 8718 2018 with our comprehensive online solution, you can always be confident it will be legally binding and admissible in court. Prepare and submit documents in the most effective manner possible!

- Open the selected file for further processing.

- Utilize the top panel to insert Text, Initials, Image, Check, and Cross annotations to your template.

- Highlight the most important elements and obscure or delete the sensitive ones if necessary.

- Click on the Sign tool above and choose your preferred method to eSign your document.

- Sketch your signature, type it in, upload an image of it, or select another option that works for you.

- Navigate to the Edit Fillable Fields panel and position Signature areas for additional signers.

- Click on Add Signer and enter your recipient’s email to assign this field to them.

- Verify that all information provided is complete and accurate before clicking Done.

A determination letter from the IRS provides official notification regarding the tax status of an organization. Typically, it addresses issues like tax exemption or status changes. Understanding your determination letter is critical for maintaining compliance. If you need assistance, US Legal Forms can simplify the process of obtaining this document.

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.