Loading

Get Irs 8633 2003-2026

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8633 online

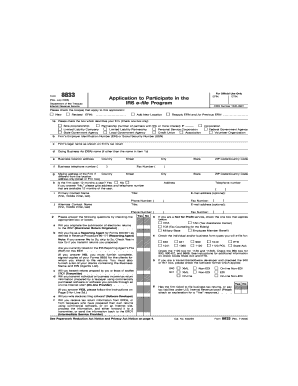

Filling out the IRS Form 8633 is a vital step for individuals and organizations wishing to participate in the IRS e-file program. This guide provides a clear, step-by-step process tailored for all users, regardless of their legal experience.

Follow the steps to successfully complete your IRS 8633 application.

- Click ‘Get Form’ button to obtain the form and open it in the editor.

- On the first page of the form, check all boxes that apply to your application. This includes indicating if you are a new applicant, making revisions, or adding a new location.

- Provide your firm’s legal name as it appears on the tax return, and the Doing Business As (DBA) name if applicable. Ensure accuracy to avoid processing delays.

- Fill in the business location address and telephone number. If your mailing address is different, complete that section as well.

- Indicate if the firm is open year-round and provide contact names who can address IRS inquiries.

- Answer the eligibility questions regarding electronic return origination. Check the appropriate boxes based on your operations.

- List the principals of your firm and provide necessary information such as name, title, address, and Social Security Number. Ensure compliance with licensing and bonding requirements.

- Complete the Responsible Official section if necessary, identifying the primary contact with the IRS.

- Read through the Applicant Agreement, confirming all information to be accurate and true before signing.

- Review your completed form for accuracy. Save your changes, and then download, print, or share the form as needed.

Complete your IRS Form 8633 online today to ensure your participation in the e-file program.

To fill out an IRS withholding form, start by downloading the current Form W-4 from the IRS website. Provide your personal information, choose your filing status, and indicate any allowances you wish to claim. Be sure to follow the instructions carefully, as any errors can affect your tax withholding accuracy. For additional support, explore the benefits of IRS 8633, which can guide you through compliance.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.