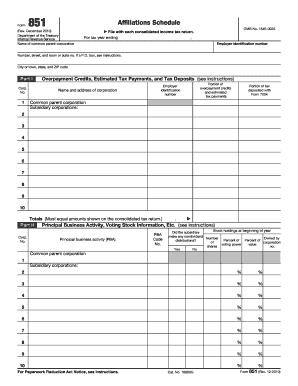

Get Irs 851 2010

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 851 online

How to fill out and sign IRS 851 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

When you're not linked to document management and legal operations, completing IRS forms can be unexpectedly anxiety-inducing. We completely understand the significance of accurately finalizing documents.

Our online software offers a method to simplify the process of submitting IRS forms as much as possible. Adhere to these instructions to correctly and swiftly complete IRS 851.

Using our platform can certainly facilitate proficient completion of IRS 851. We'll do everything to ensure your work is comfortable and efficient.

Select the button Get Form to access it and begin editing.

Complete all mandatory fields in the chosen document using our robust and user-friendly PDF editor. Activate the Wizard Tool to streamline the process even further.

Verify the accuracy of the filled information.

Include the date of completion for IRS 851. Utilize the Sign Tool to affix your signature for document validation.

Finish editing by clicking Done.

Submit this document to the IRS using the method that suits you best: via email, digital fax, or traditional mail.

You have the option to print it on paper if a physical copy is necessary and download or save it to your preferred cloud storage.

How to alter Get IRS 851 2010: customize forms online

Handling documents is more convenient with intelligent online tools. Remove paperwork with easily downloadable Get IRS 851 2010 templates that you can adapt online and print out.

Drafting papers and documents should be more straightforward, whether it's a routine aspect of one’s job or sporadic tasks. When an individual needs to submit a Get IRS 851 2010, understanding rules and guidelines on how to fill out a form correctly and what it should comprise might take considerable time and effort. Nevertheless, if you find the appropriate Get IRS 851 2010 template, completing a document will cease to be an obstacle with an efficient editor at your disposal.

Leverage the Highlight tool to emphasize the significant sections of the form. If you need to obscure or eliminate certain text areas, use the Blackout or Erase tools. Personalize the form by incorporating standard graphic elements. Use the Circle, Check, and Cross tools as necessary to add these features to the forms. For additional notes, utilize the Sticky note tool and place as many notes on the forms page as needed. If the form requires your initials or date, the editor possesses tools for those purposes as well. Minimize the chance of mistakes with the Initials and Date instruments. Custom graphic elements can also be added to the form. Utilize the Arrow, Line, and Draw tools to personalize the document. The more tools you master, the easier it is to handle Get IRS 851 2010. Experiment with the solution that provides everything necessary to locate and adjust forms within a single browser tab and say goodbye to manual paperwork.

- Explore a broader range of features you can introduce to your document workflow routine.

- No need to print, complete, and annotate forms manually.

- With a smart editing platform, all necessary document processing functions are readily available.

- If you aim to enhance your work process with Get IRS 851 2010 forms, locate the template in the catalog, select it, and discover a simpler approach to filling it in.

- If you want to insert text in an arbitrary location of the form or add a text field, utilize the Text and Text field tools, and extend the text in the form as much as you need.

Get form

IRS Code 851 refers to the regulations governing the tax treatment of corporations and their shareholders. This code establishes requirements for properly reporting ownership structures and income distributions. Staying informed about IRS Code 851 can enhance your understanding of corporate tax obligations.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.