Loading

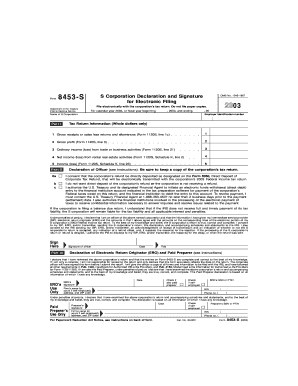

Get Irs 8453-s 2003

This website is not affiliated with IRS

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-S online

The IRS 8453-S form is essential for S corporations, enabling authentication of their electronic tax returns. This guide provides step-by-step instructions to help users complete the form accurately and efficiently.

Follow the steps to fill out the IRS 8453-S online.

- Press the ‘Get Form’ button to access the IRS 8453-S form and open it in your preferred editor.

- Fill in the corporation's name in the designated space to identify the entity accurately.

- Enter the employer identification number (EIN) of the corporation, ensuring it matches IRS records for proper processing.

- In Part I, complete the financial information by entering appropriate amounts for gross receipts, gross profit, ordinary income/loss, and net income/loss as specified in the respective lines.

- Proceed to Part II and authorize any direct deposit of refunds by checking the relevant box. If opting for direct withdrawal for tax payments, provide necessary financial account details as prompted.

- Have a corporate officer sign and date the form in the designated area as a declaration of the information provided.

- If applicable, fill out Part III for the Electronic Return Originator (ERO) and paid preparer information, ensuring all required signatures are present.

- Once all sections are complete, save the form changes, and ensure it is ready for electronic submission. You may also choose to download, print, or share the completed form as needed.

Complete your IRS 8453-S form online today to ensure smooth processing of your corporation's tax return.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

To send form 8453 to the IRS, simply mail it to the address provided in the instructions associated with the form. Make sure to include any required documentation along with your submission. If you use US Legal Forms, you can streamline the process and follow the necessary steps with confidence.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.