Loading

Get Irs 8453-eo 2011

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

How to fill out the IRS 8453-EO online

Filling out the IRS 8453-EO form is an essential step for exempt organizations that are submitting their electronic returns. This guide provides clear instructions on how to complete the form effectively, ensuring compliance and accuracy for your filing.

Follow the steps to fill out your IRS 8453-EO form accurately.

- Click ‘Get Form’ button to obtain the form and open it in your preferred editor.

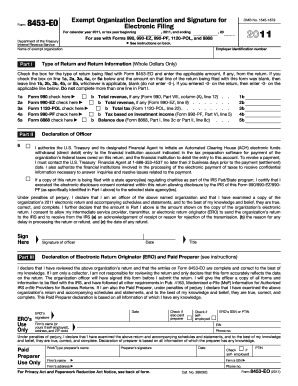

- Begin with Part I of the form. Here, you will need to check the appropriate box for the type of return you are filing (e.g., Form 990, Form 990-EZ, etc.). Enter the total revenue or applicable amount from the return associated with this filing if applicable. Ensure that you only complete one line in this section.

- Proceed to Part II. In this section, you will authorize the U.S. Treasury to initiate an Automated Clearing House (ACH) electronic funds withdrawal for federal taxes owed. Fill in the financial institution account information as required, including routing and account numbers, account type, debit amount, and debit date.

- Continue to the signature area in Part II. Ensure that an authorized officer of the organization signs and dates the form. This officer must be someone in a senior role, such as a president or treasurer.

- Move to Part III where declarations by the Electronic Return Originator (ERO) and paid preparer are made. If you are using an ERO, ensure their information and signature are provided.

- Review all sections to confirm that the information provided is complete and accurate. Make any necessary corrections.

- Save the completed form. After verification, you can save it, download, print, or share the form as you need.

Complete your IRS 8453-EO form online to ensure a seamless filing experience.

Get form

Experience a faster way to fill out and sign forms on the web. Access the most extensive library of templates available.

Related links form

You can obtain IRS instruction booklets directly from the IRS website or by visiting a local IRS office. These booklets contain vital information and guidance on filling out various forms, including IRS 8453-EO. Additionally, uslegalforms provides resources that simplify complex instructions, so be sure to check there for more help.

Get This Form Now!

Use professional pre-built templates to fill in and sign documents online faster. Get access to thousands of forms.

Industry-leading security and compliance

US Legal Forms protects your data by complying with industry-specific security standards.

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.