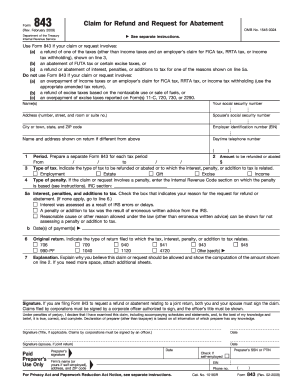

Get Irs 843 2009

How it works

-

Open form follow the instructions

-

Easily sign the form with your finger

-

Send filled & signed form or save

Tips on how to fill out, edit and sign IRS 843 online

How to fill out and sign IRS 843 online?

Get your online template and fill it in using progressive features. Enjoy smart fillable fields and interactivity.Follow the simple instructions below:

If individuals aren’t linked with document management and legal procedures, submitting IRS documents can be quite tiring. We understand the importance of accurately completing documents. Our service provides a means to simplify the process of submitting IRS forms.

Follow these instructions to promptly and correctly finalize IRS 843.

Utilizing our comprehensive solution can undoubtedly make proficient completion of IRS 843 a reality. Make everything conducive for your comfortable and secure operations.

Press the button Get Form to access it and begin editing.

Complete all required fields in the document using our effective PDF editor. Activate the Wizard Tool to make the procedure even simpler.

Verify the accuracy of the included information.

Include the date of completing IRS 843. Utilize the Sign Tool to create a unique signature for document authorization.

Finish the editing process by clicking on Done.

Submit this document directly to the IRS in the most convenient method for you: via email, using digital fax, or regular mail.

You may print it on paper when a physical copy is necessary and download or save it to your preferred cloud storage.

How to modify Get IRS 843 2009: personalize forms online

Streamline your document creation process and tailor it to your specifications within moments. Complete and authorize Get IRS 843 2009 with a thorough yet intuitive online editor.

Drafting documents is consistently challenging, especially when you tackle it sporadically. It requires you to meticulously adhere to all protocols and accurately populate all sections with precise and complete information. Nonetheless, it frequently occurs that you need to modify the form or add extra sections to complete. If you wish to enhance Get IRS 843 2009 before submitting it, the ideal method is to utilize our robust yet simple online editing capabilities.

This exhaustive PDF editing tool enables you to swiftly and effortlessly complete legal documents from any internet-enabled device, implement essential modifications to the template, and include additional fillable fields. The service permits you to designate a specific area for each data category, such as Name, Signature, Currency, and SSN etc. You can make them mandatory or conditional and determine who is required to fill out each section by assigning them to a particular recipient.

Follow the steps below to alter your Get IRS 843 2009 online:

Our editor is a flexible multi-featured online tool that can assist you in promptly and effortlessly refining Get IRS 843 2009 and other documents according to your requirements. Minimize document preparation and submission duration and ensure your paperwork presents a professional appearance without difficulty.

- Access the necessary file from the directory.

- Complete the empty fields with Text and use Check and Cross tools for the tick boxes.

- Employ the right-hand toolbar to modify the template with new fillable sections.

- Select the fields based on the type of information you wish to collect.

- Designate these fields as required, optional, or conditional and rearrange their order.

- Allocate each field to a designated individual using the Add Signer tool.

- Verify if you’ve made all the necessary changes and click Done.

Get form

The IRS underpayment penalty often stems from not paying enough tax throughout the year, either through withholding or estimated tax payments. If you underpay your taxes by a certain percentage, the IRS may impose penalties on the outstanding balance. Being aware of how these penalties work can help you stay compliant and avoid using IRS 843 unnecessarily.

Get This Form Now!

Industry-leading security and compliance

-

In businnes since 199725+ years providing professional legal documents.

-

Accredited businessGuarantees that a business meets BBB accreditation standards in the US and Canada.

-

Secured by BraintreeValidated Level 1 PCI DSS compliant payment gateway that accepts most major credit and debit card brands from across the globe.